ANZ Rewards is the loyalty program of Australia and New Zealand Banking Group Limited. As a ‘flexible’ points currency, the program allows members to collect points when making an eligible purchase on a range of ANZ cards.

This versatile points program offers a range of redemption options across a handful of frequent flyer programs, as well as gift cards, retail products and cashback.

Whether members prefer to take to the skies or shop until they drop, there’s likely a reward for every cardholder to enjoy.

Overview of ANZ Rewards

In the name of flexibility, an ANZ Rewards card makes it possible for cardholders to earn ANZ Reward Points through limited time bonus offers and on everyday spend.

Travel-savvy card holders can choose to transfer Reward Points across to a range of popular frequent flyer programs, including Velocity Frequent Flyer, Singapore Airlines KrisFlyer, Cathay Pacific Asia Miles and Air New Zealand Airpoints.

In this guide, we will provide a breakdown of the ANZ Rewards program, including how best to earn and redeem ANZ Reward Points for maximum value. Let’s dig in.

How to earn ANZ Reward Points

ANZ currently offers two Reward Points earning cards, each with different offers and earn rates. The lineup of ANZ Reward cards is as follows:

As with many Qantas Points-earning cards, ANZ Rewards credit cards that come with a larger introductory bonus and higher earn rate will usually attract a higher annual fee.

All of the cards in the ANZ Rewards lineup allow transfers to Velocity Points, KrisFlyer Miles, Asia Miles, and New Zealand Airpoints. We’ll dig further into specific airline partner-earning and transfer rates below.

Another notable upside across each of the products is that they come with uncapped annual points-earning capabilities. While there are monthly thresholds in place for higher earn rates, cardholders can earn points year-round on all eligible purchases.

ANZ Reward Points will, however, expire 36 months after the end of the year in which they were earned. It’s also worth noting that additional cardholders will each attract a $65 annual fee.

The table below provides an overview of what points and features are on offer across the different products.

| Card/feature | ANZ Rewards Platinum | ANZ Rewards Black |

|---|---|---|

| Points earn* (on eligible purchases) | Up to 1.5 Reward Points per $1 spent | Up to 2 Reward Points per $1 spent |

| Annual fee (AUD) | $95 (free for the first year) | $375 |

| Introductory offer | 50,000 ANZ Reward Points | 50,000 ANZ Reward Points |

| Minimum credit limit (AUD) | $6,000 | $15,000 |

| Overseas transaction fees | Yes | Yes |

| Annual points earn cap | Uncapped | Uncapped |

| Points expiry | 36 months | 36 months |

*All ANZ Rewards credit cards feature a reduced points earning rate above a certain amount spent per statement period. You can learn more about this in the ANZ Rewards program terms and conditions here.

Maximising points earn with ANZ Rewards

Aside from the ability to earn points when you pay with an ANZ Rewards card, there are a small number of additional ways to boost an ANZ Rewards balance.

Introductory offers

Introductory offers mean eligible new card account holders can earn a surge of bonus points when being approved for an ANZ Rewards credit card and meeting minimum spend criteria.

While offers can vary, ANZ Rewards currently offers sizeable bonuses across the stable of products. For example, new ANZ Rewards Black credit card holders can currently earn 80,000 bonus Reward Points by spending $2,000 on eligible purchases in the first three months (new cards only, other T&Cs apply).

It’s worth noting that these offers only apply to new cardholders, meaning that members won’t be eligible for an introductory bonus if they currently hold, or have held an ANZ Rewards or ANZ Frequent Flyer credit card within the past 24 months.

Other ways to maximise ANZ Reward Points earn

There’s nothing worse than indulging in fine dining and realising you forgot your points-earning card at home.

ANZ Rewards cards offer easy payment options, including the ability to access Apple Pay and Google Pay, which can be a good way to ensure you are maximising points-earn by always having that points-earning card handy.

What counts as qualifying spend?

Not every spend category is equal, and it’s worth knowing that you’ll only earn points on what counts as ‘eligible spend’. Qualifying spend includes most everyday spending categories including groceries, fuel, retail therapy, entertainment and dining.

ANZ Rewards members will not, however, earn Reward Points on interest charges, premiums paid for ANZ Credit Card Insurance, government charges, payments made to the Australian Taxation Office, bank fees, balance transfers or cash advances.

You can find more information about eligible spend in the ANZ Rewards Program Terms and Conditions.

How and where to redeem ANZ Reward Points

ANZ Rewards members have multiple options when it comes to using ANZ Reward points, meaning there’s a compelling redemption opportunity for just about everyone.

While the list of partner airlines may not be as extensive as American Express Membership Rewards, members of ANZ Rewards can still shoot for the sky by transferring points to a handful of frequent flyer programs.

Purchasing gift cards, getting cashback or shopping via the ANZ Rewards Store provides some additional ways to use ANZ Reward Points.

Transfer to airline partners

Frequent flyer points-minded members looking for a way to extract maximum value from ANZ Reward Points may find that transferring to the program’s airline partners is the best option.

ANZ Rewards partners with four frequent flyer programs that offer varying transfer ratios. These airline transfer partners are:

- Velocity Frequent Flyer (Virgin Australia)

- KrisFlyer (Singapore Airlines)

- Asia Miles (Cathay Pacific)

- Airpoints (Air New Zealand)

The table below outlines each of the ANZ Rewards airline partners, their transfer ratios as well as minimum transfer requirements.

| Frequent Flyer program | Transfer ratio | Minimum transfer | Redemption time |

|---|---|---|---|

| Velocity Frequent Flyer | 2 ANZ Reward Points = 1 Velocity Point | 2,000 ANZ Reward Points = 1,000 Velocity Points | Within 5 business days |

| KrisFlyer | 3 ANZ Reward Points = 1 KrisFlyer Mile | 1,500 ANZ Reward Points = 500 KrisFlyer Miles | Within 15 business days |

| Asia Miles | 3 ANZ Reward Points = 1 Asia Mile | 1,500 ANZ Reward Points = 500 Asia Miles | Within 18 business days |

| Airpoints | 200 ANZ Reward Points = 1 Airpoints Dollar | 2,000 ANZ Reward Points = 10 Airpoints Dollars | Within 6 business days |

The relatively slow timeframe for completing transfers is somewhat of a downside here, particularly compared to American Express Membership Rewards, which completes transfers in as little as 48 hours for selected partners.

The next table provides a breakdown of the effective airline transfer earn rates across each of the products in the ANZ Rewards lineup.

| Frequent flyer program | ANZ Rewards Platinum earn rate | ANZ Rewards Black earn rate |

|---|---|---|

| Velocity Frequent Flyer | 0.75 point per $1 | 1 point per $1 |

| Kris Flyer | 0.5 mile per $1 | 0.66 mile per $1 |

| Asia Miles | 0.5 mile per $1 | 0.66 mile per $1 |

| Airpoints | 0.0075 Airpoints per $1 | 0.010 Airpoints per $1 |

Velocity Frequent Flyer

Members of Velocity Frequent Flyer – one of Australia’s most popular airline loyalty programs – can take advantage of a handy Auto-Redemption feature.

This simple tool means that similar to NAB Rewards, an ANZ Reward Points balance will automatically be transferred to a Velocity Frequent Flyer account at preferred intervals. Essentially, topping up a frequent flyer balance this way can be a convenient way to maximise ANZ Reward Points.

Setting Auto-Redemption up is quite straightforward. Simply follow these steps:

- Log into your ANZ Rewards account

- Select ‘airline partners’ from the top menu

- Navigate to Velocity Frequent Flyer

- Scroll down and click the ‘set up Auto-Redemption’ button

Singapore Airlines KrisFlyer

As a member of Star Alliance, KirsFlyer offers access to redemptions on Singapore Airlines and 25 other Star Alliance members, including THAI Airways, Lufthansa and United Airlines. This means converting ANZ Reward Points into KrisFlyer miles could potentially open up a whole world of travel opportunities.

Note that ANZ Rewards members who wish to transfer to KrisFlyer will need to call the ANZ Rewards Centre on 1300 3367 763. Though this redemption can be started online, details will need to be verified over the phone within seven days.

Cathay Pacific Asia Miles

With over 800 partners, Asia Miles makes it possible to earn miles almost anywhere. A transfer of ANZ Reward Points to Asia’s leading travel rewards program will similarly need to be completed by calling the Reward Centre.

Air New Zealand Airpoints

Airpoints is New Zealand’s loyalty program, however, it offers by far the least compelling transfer rate. We wouldn’t recommend transferring ANZ Reward Points to Airpoints Dollars unless you have a specific requirement to redeem for an Air New Zealand flight.

Other ways to use ANZ Reward Points

Aside from aspirational Reward Points transfers to airline partners, ANZ Rewards also offers myriad ways to redeem points on the ground.

Members can use points to purchase retail products, gift cards, or receive cashback on an ANZ Rewards credit card or ANZ bank account.

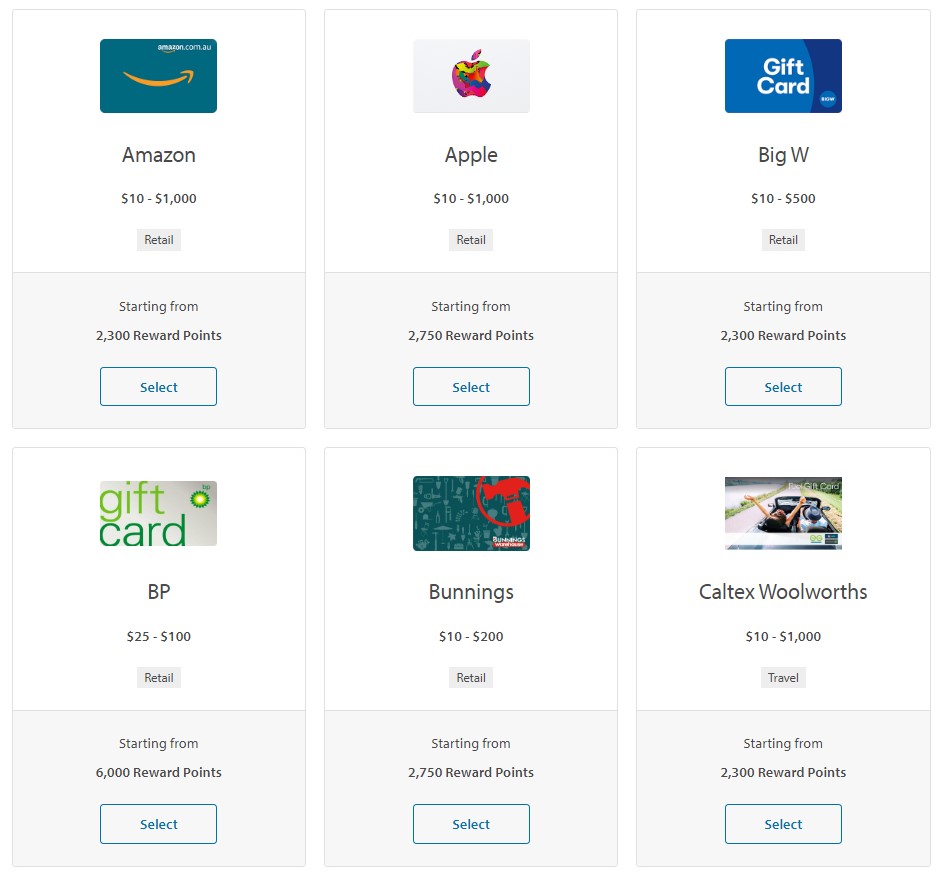

Gift Cards

A range of gift cards is available across various retail categories. From Amazon to Coles and Gourmet Traveller, there’s a gift card voucher for just about every kind of shopper.

Gift cards start at $10 using 2,300 Reward Points and go up to $1,000 for 220,000 points. The table below outlines the redemption value across various denominations.

| Gift card amount (AUD) | Redemption value |

|---|---|

| $20 | 4,445 Reward Points |

| $50 | 11,115 Reward Points |

| $100 | 22,225 Reward Points |

| $200 | 44,445 Reward Points |

| $500 | 111,000 Reward Points |

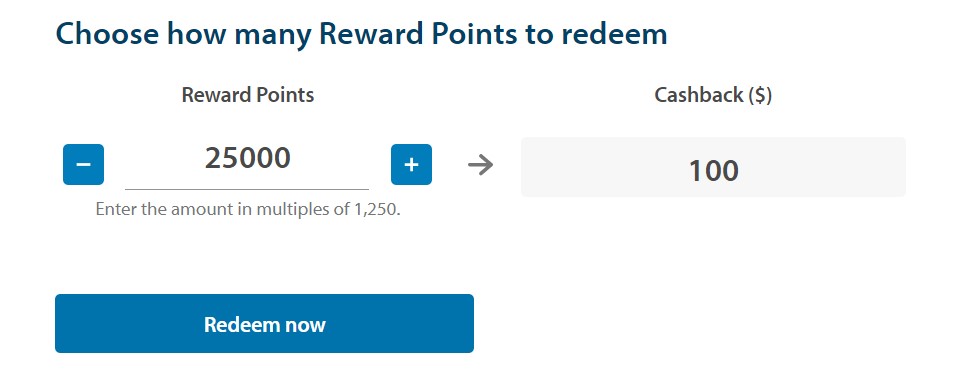

Cashback

ANZ Rewards members can use Reward Points to cover some of the balance of an ANZ Rewards credit card or eligible ANZ bank account, or alternatively, receive cash in their pocket.

With this reward, members will get $5 back for every 1,250 Reward Points, meaning 25,000 Reward Points will need to be redeemed to get $100 back.

Though not as aspirational as airline partner transfers, cashback redemptions offer slightly better value than using Reward Points for gift cards.

It’s worth noting that cashback will not count towards a minimum monthly repayment.

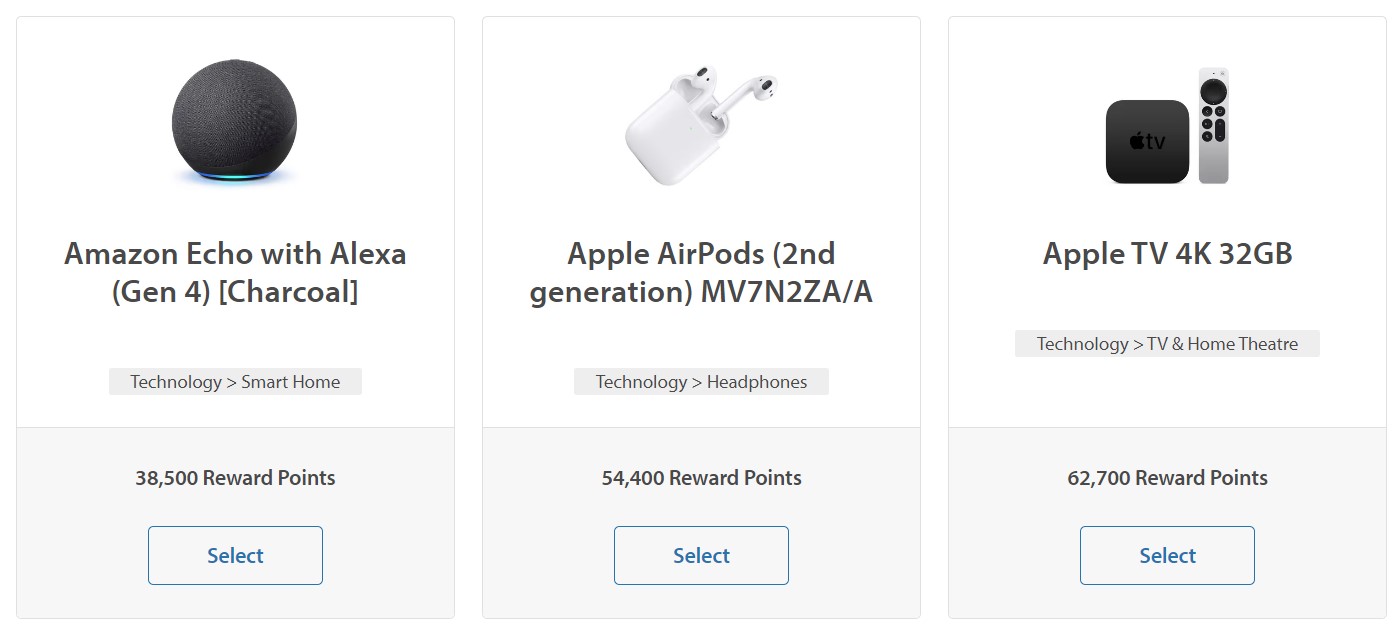

ANZ Rewards Store

The ANZ Rewards Store offers a large selection of brand favorites across various shopping categories. Members can peruse technology, kitchen, fitness, travel, kids, fashion, home and outdoors categories and shop from major brands including:

| Amazon | Garmin |

| Apple | Myer |

| Breville | Samsung |

| Bunnings | Smeg |

| De’Longhi | Sony |

While retail product redemptions typically front the worst redemption value, they can make sense for members with a specific goal in mind.

How much is 1 ANZ Reward Point worth?

The value of 1 ANZ Rewards Point depends entirely on the choice of redemption; some ways to use ANZ Reward Points offer better value than others.

Transferring to airline partners typically offers the most ideal value proposition. For example, the value per point could be up to 5 cents or more when redeemed to transfer to Velocity Frequent Flyer and then used to book business or first-class redemptions via Singapore Airlines, Etihad, or Qatar Airways.

Cashback redemptions can be valued at 0.4 cents per Reward Point, offering a slightly higher value than gift cards, which we have calculated to be worth 0.375 cents per point.

Rewards Store redemptions, on the other hand, vary slightly between products, however, we have calculated the value to be 0.42 cents per point using an iPhone 13 Mini 512 GB costing 370,000 ANZ Reward Points. However, this particular product can be purchased outright for $1,569, so the tangible value on offer here isn’t particularly admirable.

Digging into the ANZ Rewards and Cashrewards partnership

ANZ Rewards credit card holders who shop via Cashrewards can ‘double dip’ on perks by getting cashback as well as earning ANZ Reward Points.

Cashrewards is one of Australia’s leading cashback programs that allow shoppers to access cashback offers from more than 2,000 leading retailers including Amazon, Menulog, and Booking.com.

ANZ’s Cashrewards partnership appears to have replaced the Bonus Points Mall, which, similar to the Qantas Shopping portal, previously allowed cardholders to earn bonus points on spending at certain retailers prior to ANZ Rewards’ program upgrade.

Members can now start maximising points earn and cashback rewards by simply logging into ANZ Rewards and linking their ANZ credit card to Cashrewards. Not a Cashrewards member yet? Find out more about joining here.

Summing up: Getting maximum value with ANZ Rewards

ANZ Rewards is an ideal program for those who are seeking flexibility and a choice of redemption opportunities in the air and on the ground, including valuable airline transfers, cashback offers, and retail therapy.

The most competitive earning rates within the ANZ Rewards credit card lineup can certainly be accessed with an ANZ Rewards Black card.

However, those looking for a Qantas-linked credit card may choose to look further afield at the ANZ Frequent Flyer Black and ANZ Frequent Flyer Platinum.

Annual uncapped points-earning means cardholders are encouraged to shoot for the stars with the freedom to take a little longer to decide on a reward goal.

FAQ – ANZ Rewards

Do ANZ Rewards Points expire?

Yes. ANZ Reward Points expire within 36 months of 31 December of the year in which they were earned.

Can I transfer ANZ Reward Points to Qantas?

No. Currently, ANZ Reward Points cannot be transferred to Qantas Frequent Flyer. However, ANZ offers a number of Qantas Points-earning credit cards, including the ANZ Frequent Flyer Platinum card.

How much are 5000 ANZ Reward Points worth?

It depends on how the points are used. The value of 5000 Reward Points could be $250 or more when redeemed for business or first-class redemptions via Velocity. Conversely, the value could be much less when used for gift cards, goods, or cashback.

While you’re here: Subscribe to our newsletter for the latest tips, deals and news. It only takes a few seconds and we respect your privacy: