UPDATE: As of Feb 22, 2021 TransferWise has changed its name to “Wise”, to reflect the fact that the company is more than simply money transfers.

For frequent international travellers or those who often send money overseas, exchanging currencies can become a nightmare. Often, we lose out to the banks that offer fictional exchange rates and a considerable serving of fees, simply because they can.

Enter Wise, a currency exchange service that’s recently exploded onto the scene in Australia, promising true mid-market rates.

If you frequently transfer money overseas, you might have heard of this currency exchange service. Having launched locally a few years back, this platform is fast becoming viable for people who live and work in Australia — and even Australian ex-pats.

As a current user, I’ve put together this Wise review to tell you everything you need to know about using Wise in Australia, and also around the world.

First Up: What exactly is Wise?

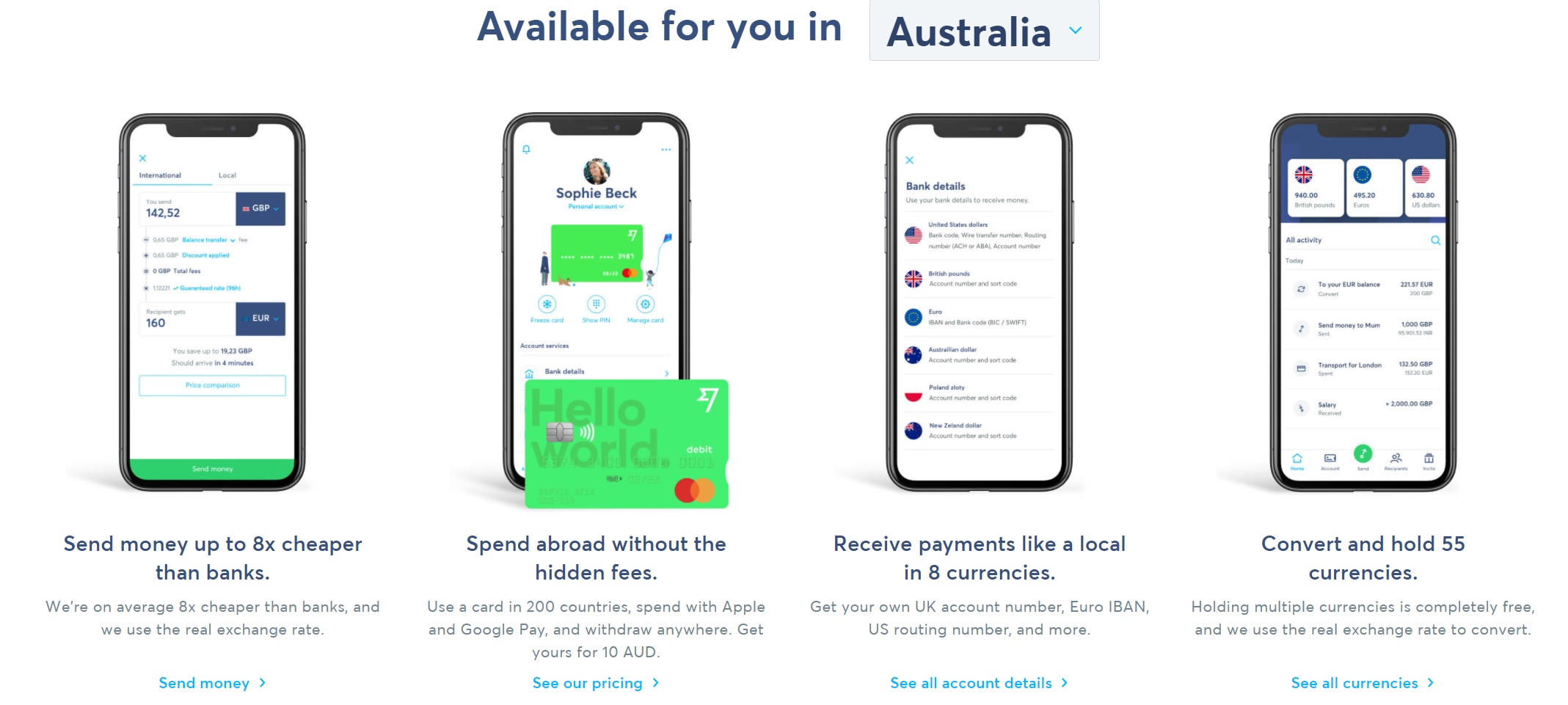

Wise is an international money wire company that enables people around the world to send money easily. Wise Australia provides options for online money transfers in many major currencies; including Euros, GBD, USD, AUD, NZD, SGD, and more than 50 others. In a nutshell, Wise seeks to make it quick, safe, and fast to transfer money abroad.

How Does Wise Work?

Wise Australia uses the real exchange rate to exchange currencies all around the world. The online platform works like a bank account. Users can send and receive money from almost anywhere in the world at mid-market exchange rates for a low fee.

Wise takes all the high fees and guesswork out of bank exchanges and wire transfers. Instead, you can get your money quickly and easily with the ability to convert it into the currency that you need — all on one platform.

Think of Wise Australia as an international bank account with a market exchange rate. You can move money in and out and even withdraw at an ATM. You will do this using a regular Wise Wisecard, just like you do at home.

All you have to do is sign up, verify your identity, and link your bank account. Wise is secure and regulated by trusted financial institutions around the world.

Wise Pros and Cons

Ultimately, using Wise in Australia is a matter of weighing the pros and cons of the platform. No money transfer service is perfect, after all. So what are the pros and cons of Wise, and how do you decide if it is the right choice for you?

Wise products and services

Wise offers a range of products and services to meet the individual needs of Australian consumers and business owners. These include:

Wise Borderless Account

The Wise Borderless Account is for anyone who works or roams around the world. This account lets you store up to 50 types of currency between four international bank accounts. These details are stored all in one place so that you can easily convert and withdraw money or use Wise as a payment method wherever you are.

The Borderless Account is ideal for anyone who frequently travels, and who wants to ditch their credit card. It could be especially useful for those who work for international clients. All conversions are done with real exchange rates to make it easier on your wallet.

It also lets you use four international bank accounts in one of four currencies. These include the Australian Dollar, GBP, EUR, and ESD. If this seems confusing, it gets more elaborate — within those accounts, you can hold up to 50 types of international currency.

There is no limit to the number of transactions you can make. Although there are associated fees with money conversion, these are lower than any bank conversion. Wise Australia also strives to keep these fees transparent, so you always know what you will pay.

Wise Multi-Currency Account

To unlock all the features that Wise Australia offers, you’ll need to open a multi-currency account. It’s an easy, no-fuss alternative to setting up a bank account abroad.

The Multi-Currency Account allows you to keep more than 50 types of currency and qualify for a Wise debit card. You can also convert currencies directly in your account for a modest fee.

The multi-currency account lets you receive money in AUD, EUR, GBP, NZD, PLN, and USD without paying extra fees. You can also use your debit card to spend money in any currency.

When you sign up for a Wise multi-currency account, you will need to verify your identity. In Australia, this means that you will need to provide proof of ID (such as an Australian Drivers License or passport) and proof of Australian residency. This process can take up to two days.

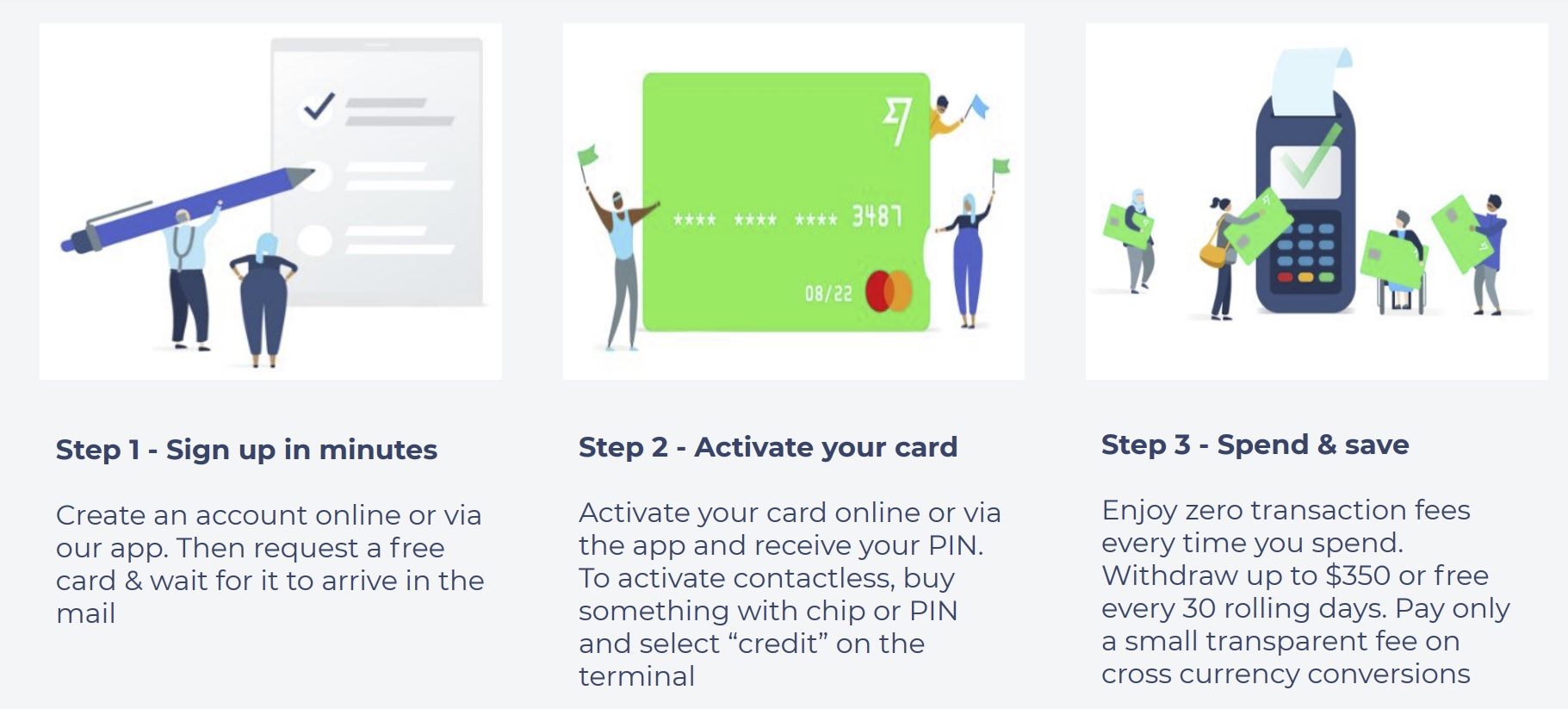

Wise Debit Card

When you open a Wise account, you have the option to add on a Wise Platinum Debit Mastercard as well.

The Wise debit card can hold over 40 currencies and could be up to 11 times cheaper than a regular debit or travel card when moving money around the world.

The Wise Debit Card functions just like a debit card you’d use from an Australian bank, and a Wise account like an international bank account.

Your debit card is welcome anywhere Mastercard is accepted, and it can be used at qualifying ATMs around the world. You can use the Wise Debit Card to withdraw money and change it to the local currency, provided you are in a country like Australia that qualifies.

When you get your Wise Debit Card, be sure to activate it right away. You can do this either on the website or through the Wise app. Put in the code on the card and set your PIN. Then, as long as you have money in your account, you can start using the card immediately.

When you withdraw money from your account, Wise does the currency conversion for you. If you want to convert to a currency that you don’t have in your account, it’s handy to know that Wise will choose the currency with the lowest conversion fees. This helps you save money.

Wise for Business

If you’re a business owner in Australia like me, you may be able to benefit from using Wise Australia for Business for day-to-day transactions. Opening a business account takes a few extra steps, but it is also quite straightforward. This is an excellent option for you if you own a business that partners with clients, employees, contractors, or suppliers worldwide.

How to Sign Up for Wise Australia

No matter what kind of account you sign up for, it’s a quick and easy process. Even better, it’s free to sign up. There may be a small fee associated with signing up for a Wise debit card.

Opening a Personal Account

To open a personal account with Wise Australia, all you have to do is sign up and then log in. You will need to verify your identity using Australian ID documents and a bank account and connect to your bank. Then, you can set up your security protocols and get started.

A personal account lets you use up to four different bank accounts and 40 international currency types. It is easy and straightforward to open a Wise personal account in Australia and only takes a few short minutes.

Opening a Wise for Business Account

Unlike many bank accounts, a Wise for Business account is also free. You will, however, be required to verify your own identity and the legitimacy of your business. But this only takes a few minutes. Then you can get started.

Verifying your business usually means providing the name of your company, Australian Business Number (ABN), business registration information, and industry. You will also need to provide the names and information of any business owners or directors. Once you have entered this information, you can proceed to set up your first-time transfer.

Wise Australia will take a few days to verify your business account. After it finishes, your transfer will go through.

One of the key benefits of using Wise Australia for your business is that you can automate your payments and finances. The platform also supplies a wide variety of accounting tools that can help you better keep track of cash flow.

When to Use Wise to Transfer Money Overseas

Wise Australia can be a compelling option for anyone who needs to transfer money abroad. And you might be surprised to know that 1 in every £25 sent by people around the world is with Wise!

But this service is particularly well-suited for you if the following conditions apply:

You Want a Secure Platform to Send Money Abroad – Sending money abroad might make you nervous for a good reason. Some platforms like PayPal seem less secure. It is vital to have your bank account and personal information protected at all times. Wise Australia uses data encryption, double verification, and secure browsing to ensure all your information is safe at every step of the process.

You Want to Avoid High Bank Fees For International Money Transfers – Before I discovered Wise Australia, sending money overseas was something I avoided – mainly due to the high fees I was slugged via my Australian bank account. Banks charge enormous fees to move money around. If you need to do it often, those fees can quickly add up. Wise charges lower fees than banks as well as other online platforms like PayPal. This makes it much more affordable to send money almost anywhere in the world without putting stress on your wallet.

You Need to Send Money Quickly – When time is of the essence, there is no room for delay. Wise lets you send money around the world as quickly as possible. Some transfers may take up to two days, but they can be almost instantaneous if Wise receives your funds through a credit or debit card. This is as fast or faster than many comparable money transfer services.

You Make Frequent Overseas Transfers – If, like me, you need to transfer money frequently, you probably want to avoid those stacking fees. You might make a lot of money transfers abroad if you send money to family in another country or run a business that partners with international contractors or suppliers. There are plenty of other reasons why someone might make frequent overseas transfers, but they are all excellent reasons for using a service like Wise.

You Work With International Employees or Clients – If you have a business that employs people around the world — or works with many international clients — you may need to undertake frequent overseas transfers. As a business owner, using Wise can help me cut back on the financial burden and free up cash flow. Importantly, it also ensures that my overseas employees and contractors get their money as quickly as possible.

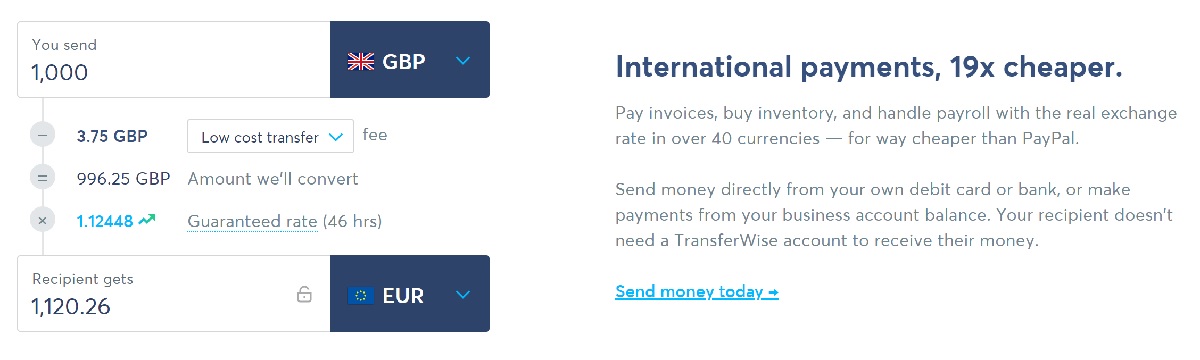

The Lowdown on Wise Fees and Exchange Rates

Like other currency exchange services, Wise makes its coin by charging fees for money transfers. Fortunately, the rates can be significantly lower than what you might expect to pay using a bank for an international wire transfer. They are also lower than many other comparable money exchange platforms such as PayPal. Wise also strives to keep all its fees transparent, so you will always know what you will be paying upfront.

Wise Debit Card Fees

Using your Wise Debit Card involves low fees for every transaction if you do not have the currency you need in your account. If you do, there is no fee. If you don’t, Wise will charge a conversion fee which is usually between .24 and 3.69 percent of the transaction.

You can make two free withdrawals of up to 350 Australian Dollars each month, after which there are associated fees.

Service Fees

It is completely free to sign up for Wise. However, if you opt to get a Wise debit card, you will need to pay a fee of 10 AUD. There is an annual fee of .40 percent if you have more than €15,000 (or 23,426 AUD) in your account.

After your two free ATM withdrawals per month, you are subject to fees of 1.50 AUD per withdrawal. The same goes for withdrawing more than 350 AUD, which will result in a fee of 1.75 percent.

Wise Exchange Rates

Currency conversion fees depend on the currencies you are using and other factors. Wise offers a free conversion calculator to estimate how much money will arrive in your account and what fees you will pay.

The company does, however, promise real exchange rates. These are the same ones you would find on platforms like Google or Reuters. This helps users save money since banks often charge higher exchange rates than they set themselves. Wise also lets you set an alert so that you know when the exchange rate improves.

What Currencies Does Wise Support?

Wise lets users transfer 750 currencies used around the world. Some of these are limited to receiving or sending, while others can be both sent and received. This includes most major world currencies, including:

- American dollar

- Australian dollar

- Euro

- Great British Pound

- Canadian dollar

- New Zealand dollar

- Japanese yen

- Indian rupee

- Turkish lira

- UAE dirham

It’s important to note that some of these currencies are limited to sending and receiving within their country of origin. Others are limited to private individuals, meaning that users cannot send the money in question to a business account.

Wise supports bank accounts that use these and many other currencies. The company is steadily working on expanding its network of supported banks and currencies.

Wise users in Australia can also keep up to 50 different currencies in the Wise multi-currency account. All users need to do is open a separate balance in a specific currency. Wise will store the money in the selected currency until you are ready to convert and withdraw it.

In addition to the 750 available currencies, Wise lets users opt for its services in one of 12 languages, including English, French, German, Spanish, Hungarian, Italian, Portuguese, Polish, Japanese, Turkish, Romanian, and Russian.

How Quick is Wise?

Wise transactions may take up to two days, however, in some circumstances they can be instantaneous. The timeframe may be longer or shorter, depending on several factors.

Firstly, the speed of transfer depends on the countries and currencies you are using. Since money passes between financial institutions worldwide, these transactions are subject to each institution’s processing protocol.

This includes multiple layers of security and identity verification. It may also involve exchanging currencies. Sending or receiving money to or from another country, especially if that country uses a different currency than you use in your account, may take some time.

Secondly, if you’re an Australian consumer, you’ll likely grumble about the fact that bank transfers typically take longer than card transfers. Card transfers, on the other hand, are likely to be available immediately.

Bear in mind that fees are also a part of transferring money between financial institutions. These fees need time to process as well. Your transfer may be available earlier or later depending on what time of day you process the payment. Because Wise only operates during standard business hours, your money may not be ready until then.

Lastly, your funds may not be available immediately due to verification checks. Because of Wise’s strict verification protocols, these may take some time. This is also the case if you are using multiple financial institutions, each of which must also verify your identity. Although delays in payments are inconvenient, every security layer must be in place to keep your information secure.

If you want an estimate on how quickly your funds will be available, Wise offers a transfer estimate tool. This lets you put in the details of your transaction to let you know how long you’ll wait for your money.

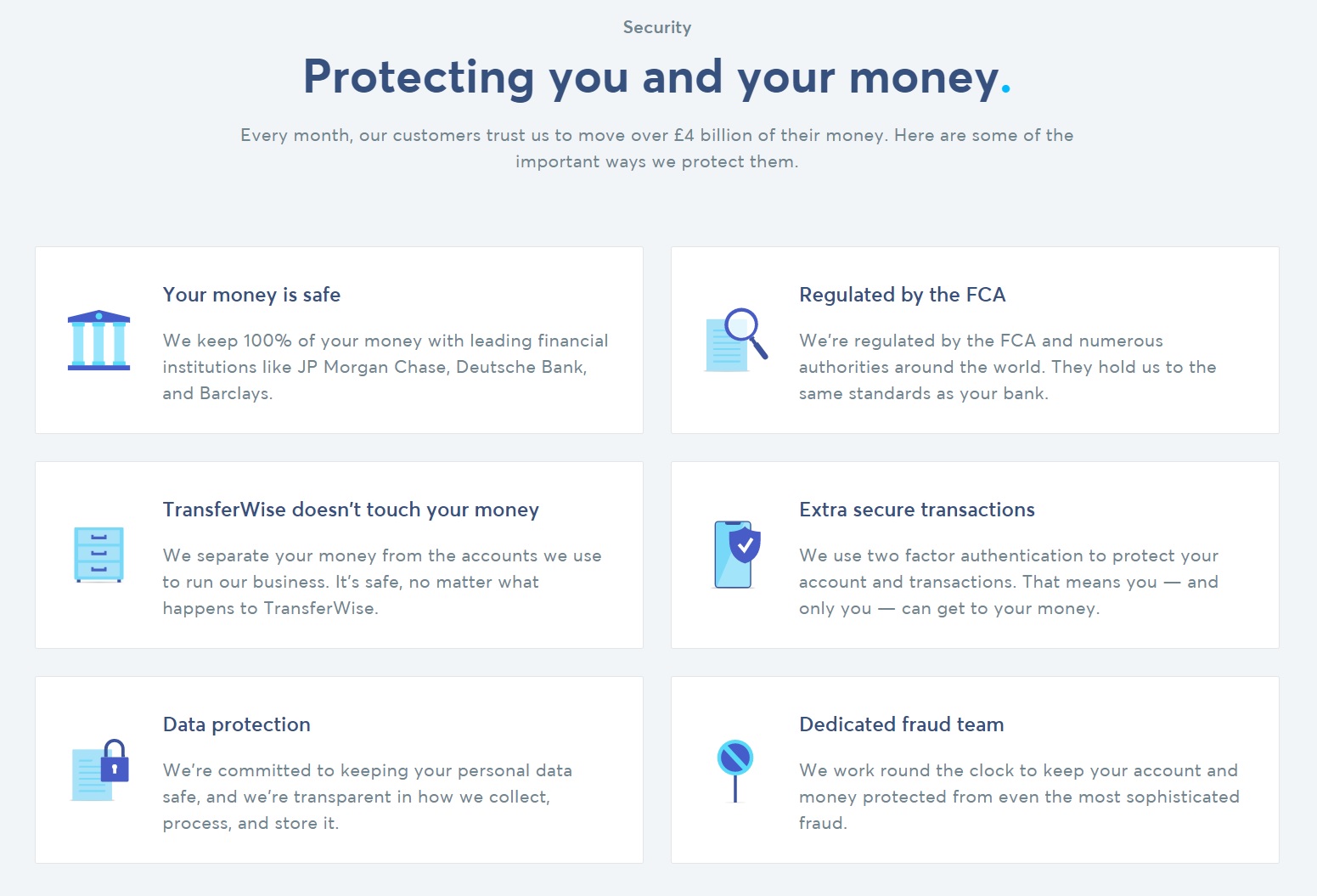

Is Wise Safe to Use?

Wise is a safe and regulated international company, and it’s trusted by millions of consumers and businesses around the world. As a global company, it is subject to the rules and regulations of financial authorities in many countries. These authorities place strict protocols on companies like Wise to keep your money and bank information secure, and to help prevent money laundering from occurring.

Like any bank, Wise’s website and mobile app are also encrypted with security software. This ensures that no one else can access your money or information. With money passing to accounts all over the world, security is a top priority for the platform.

How Wise Keeps Money Safe

When you sign up for Wise in Australia, you will receive a copy of the company’s customer agreement. This explains in detail how Wise keeps your money safe, even while sending it around the world.

Every piece of information you give Wise is encrypted and stored just as it would be in a bank account. To do this, the company protects your information with 2FA. When you log in, you must pass multiple levels of identity verification. Every session is protected by private browser connections to secure your account.

How is Wise Regulated in Australia?

Wise abides by the national regulations of the financial institutions in each country where you bank or spend money. These financial institutions require Wise to follow strict rules to keep your money safe and secure.

In Australia, this institution is the Australian Security & Investments Commission. Wise also holds an Australian Financial Services license to regulate the business it does with Australian banks. Thirdly, the company is registered with the Australian Financial Intelligence Unit. This enables the service to operate here in Australia as a money remitter.

Further afield, the company partners with other financial institutions, including:

- The Financial Conduct Authority of the United Kingdom

- The Financial Transactions Reports Analysis Centre of Canada

- The Financial Crimes Enforcement Network of the United States

- The Hong Kong Customs and Excise Department

- The Monetary Authority of Singapore

Wise is subject to the regulations of these authorities in all its business dealings within these countries. For this reason, there may be different rules for bank accounts in various countries working with Wise.

Other Wise Trust and Safety Measures

These layers of security make it safe even to send large amounts of money to overseas accounts. Through secure encryption, user verification, and secure web browsers, you can feel sure that your bank account, information, and money are protected.

In addition to these security measures, Wise partners with trusted international financial institutions around the world to move your money quickly and safely. The service operates segregated accounts with banks including JP Morgan Chase, Deutsche Bank, and Barclays.

Wise Australia Reviews and Complaints

Global Wise reviews can be found on many platforms, including Trustpilot, and Google. Here in Australia, local reviews can also be found on productreview.com.au

Customers who used Wise in Australia generally had very favourable reviews of the service. They said that transfers were quick and reliable and that their money was easy to access. Other reviews mentioned exemplary conversion rates and low fees.

Critical reviews most often mentioned limitations to customer service or long ID verification times. Slow verification increased transfer times, which meant people couldn’t get their money promptly.

Here are some positive and negative Wise Australia reviews:

“I’ve been using Wise for two businesses and two personal accounts for a number of years. I’ve never had any issues and it’s saved me a bunch of money. One thing I would like to see is integration with Zoho so I can automate my books.”

“For the last 3 years, I’ve needed to transfer funds to Canada on a regular basis. Wire transfers were a hassle. Wise is AWESOME. First transfer easy. Second transfer encountered a glitch on the website (wanted to verify identity and bank each time). Once I switched to the app…it is so fast, three clicks and done! Fees are best I’ve found…I appreciate paying a reasonable price for good service. And a bonus that you can track exchange rates, and that they tell you how fast it will show up in your account!

They have been spot on. When I needed Customer Service, they got back to me in reasonable time…had to get the right Rep to answer my question rather than send canned response; an area that they could improve.”

“Wise closed their German customer service centre. The phone number is permanently disconnected. You can only get in touch via chat. The chat is not working properly, very slow response time. Chat is basically unusable. So no more help – it is not safe to trust Wise with your money under these circumstances.” [sic]

“Been a customer for 5 years and has worked perfectly in several countries until December 2020, I was able to log in to and transfer money to my account, then it went bad They requested a new password and then a new photo. OK, after 5 years they have to up-date. They wrote back they could not confirm who I am so I sent in another, I may add I work with photos so I know what is good.

So this went on for another 7 times over a day, me sending in different photos and getting a bit angry with them, well it seems they did not like my wording of them so now my account has been de-activated and I cannot access the funds I have with them, they are in reality stealing my money.” [sic]

At the time of writing, Wise holds a 4.7 rating out of 5 stars on Trustpilot.

How to Contact Wise in Australia

Wise Australia customers can contact support in several ways. First, the website offers a 24/7 Help Centre where anyone can look for answers from other users and even connect with the community. This can be a great way of getting the answers you need without speaking to a representative.

If you need to contact Customer Support, there are also options. Users can contact support staff online via online chat. This lets them speak to either a help bot or a real representative to solve their issue.

To speak to a live Wise Australia representative, users can call +61 2 8046 6244. This will connect first to Wise’s automated phone service to select an option for the call. From here, it’s possible to transfer to a live representative.

If you have an official complaint about Wise concerning a recent transaction or hold on your account, send them a help email at [email protected]. This email should include the specifics of your complaint or query, as well as the following information:

- Your Wise membership number

- Your payment order number if your complaint is about a specific transaction

- The details of your complaint

- Your proposed solution from Wise

Comparing Wise With Other Money Transfer Services

If you’re an Australian consumer who frequently transfers money abroad, you may wonder how Wise compares to other currency exchange services. Some of the most well-known companies include TorFX, Revolut, and PayPal. So how does the competition measure up?

Wise vs. TorFX

TorFX is a similar service based in the United Kingdom, and it’s recently expanded to users in Australia and the USA. It is well-known in the world of international money transfers and focuses on customer service. The key benefit of TorFX is that it charges no fixed fees to make a money transfer. Instead, the platform earns money through exchange rates and percentage-based fees. This usually amounts to between .5 and 2 percent per transaction.

This is significantly lower in cost than banks, which usually charge between 3 and 7 percent per transaction.

However, TorFX is only appropriate for transfer amounts below 10,000 AUD or 6,000€. This is lower even than Wise’s limit. That said, TorFX can be very helpful if you plan on making small, frequent money transfers overseas.

Another benefit of TorFX is that when you sign up, you will be assigned a certified representative. This person can help you with any of your account information or transaction details.

TorFX also gives you the option to make transfers over the phone as well as online. This may be a good feature for those who are worried about cybersecurity risks.

Finally, although participating banks may charge some fees through TorFX, you may be exempt if you bank with an institution in Australia or the United Kingdom.

Wise vs. Revolut

Revolut, like Wise, offers low-cost money transfers to many different currencies around the world. But, as you probably expect, there are some differences between the two platforms. Revolut is based in the United Kingdom and aims to provide one secure platform for all your banking, finance, and investment needs.

Revolut was once for people who were travelling overseas frequently. The company provides a free debit card that you can use almost anywhere in the world. You can also do transfers in an extensive range of currencies, use “internet credit cards” to pay online, and even use cryptocurrency.

Unlike Wise, Revolut bases itself heavily on the European currency. Since 2020, coverage has been expanded to the United States and Australia. However, Revolut’s services are only available in about 34 countries compared to Wise’s 50.

Revolut does support more types of currency than Wise. However, users can only store up to 24 currency types in their account at one time. Wise, on the other hand, lets users store up to 50.

Wise may be quicker at completing transfers than Revolut, although this is a matter of user consensus. Revolut lets you receive currency in GBP, EUR, and CHF.

Revolut has more features than Wise and higher transfer limits. Although it does not charge transfer fees on every transaction, users can only go up to 1000£ ($1,764 AUD) per month before paying a 0.5 percent fee for each transfer. Users are subject to a 1 percent fee for weekend transfers. Some currencies have higher transfer amounts.

Wise vs. PayPal

PayPal is one of the most well-known and used money exchange platforms in the world. It’s widely used in Australia. But there are some real differences between PayPal and Wise.

Like Wise, PayPal has options for both personal and business accounts. PayPal also offers domestic Australian transactions as well as international transfers.

PayPal sometimes makes it a bit more straightforward to send funds since all you need is an email address. Wise, on the other hand, is quick and easy if exchanges occur between two registered site users. However, you may need to put in bank details as well.

One significant and compelling difference is that Wise has a much lower and simpler fee structure when compared with PayPal.

PayPal transfers are subject to three separate charges: a currency conversion fee, a cross-border fee, and a fixed commission. When taken together, these can add up to as much as 4.5 percent. That is on top of the exchange rate plus a fee of up to €3.99 (6.25 AUD). This is significantly more expensive than fees for using Wise in Australia.

Using the Wise App

In addition to the Wise website, you can also use Wise’s free mobile app to track your accounts. The mobile app is secure and available for both Android and iOS devices. At the time of writing, these apps boast a rating of 4+ out of 5 stars on the Google and Apple play stores.

Additionally, some currencies are available for Apple or Android Pay via the mobile app. This feature makes it even easier to access your money from anywhere in the world.

Like any bank app, the Wise app lets you view all your information right from your phone. You can also send and receive money with the click of a few phone buttons.

Wise App Benefits

- Quick, secure access to the account via mobile

- Available for both Android and iOS devices

- Excellent ratings

- Some currencies available for Apple or Android pay

Is Wise Right For You?

As a frequent traveller and small business owner, there are many reasons why Wise is an integral part of my banking and payments strategy. And depending on your personal situation, Wise could also make sense for you. Millions of people around the world use the platform to send and receive money each year. But how do you know if it is worth your while?

1# You Travel Frequently

If you are a traveller for business or leisure, you have probably found yourself struggling with a wire transfer or high exchange rates. Wise makes it easy to access your money in the currency you need at the lowest possible exchange rates. This ensures that you are never left in the lurch, no matter where you are in the world.

2# You Do Business With International Clients or Employers

Many people use Wise for their business. That might include people who own online stores with many international clients. But that is far from the only type of person who can benefit from using Wise for business purposes.

Any business that works with contractors or suppliers abroad also needs to send and receive money quickly and convert it into different currencies. Similarly, if you own a business with global employees, you can pay them quickly and securely using Wise.

Wise is not the only platform that provides these services. But running your own business is already expensive, and the bank fees associated with sending money abroad can be exorbitant. For the service, it is hard to match the company’s low fees.

3# You Work the Gig Economy as a Freelancer

If you are a freelance worker, you have probably worked with clients around the world. Wise makes it safe and easy to get paid for your work without giving out your bank information. Many freelancers are forced to get funds through services like PayPal, which charge high fees, especially if you want to withdraw your money early. With Wise, you can pay much lower fees and get your money safely.

4# You Are an International Student

If you are an international student, you probably get money from home now and then. Wise makes it easy to access your funds and convert them into other currencies without the high costs of wire transfers.

Similarly, if you want to send money to family or friends in your home country, Wise makes that possible, too.

Of course, these aren’t the only people who can benefit from the services that Wise offers. Anyone who needs to send or receive money abroad can use Wise’s services.

FAQ – Wise Australia

If you live in Australia and are curious to know more about how Wise operates locally, here are some common questions that you may have.

Is Wise Available in Australia?

Wise has been available in Australia for several years. It is regulated by the Australian Security & Investments Commission and the Australian Financial Intelligence Unit and Holds a license (AFSL) with the Australian Financial Services.

How do I Contact Wise in Australia?

To contact Wise Australia, you can speak to a customer service representative through an online chat window. Or if you prefer, you can call the Australia customer service line directly at +61 2 8046 6244. If you have a complaint regarding a transaction, you can send an email to [email protected].

Using Wise for Business Payments

To use Wise in Australia as a payment method for business, you will need to set up a business account. Wise for Business is free, just like a personal Wise account. Business accounts can be used in as many as 70 countries around the world, with real-time exchange rates in over 50 currencies.

How do I Cancel a Wise Transaction?

If the money has already been sent to Wise from your bank account, it is still possible to cancel the transaction. If you don’t see a “Cancel payment” option, contact Wise’s help centre as quickly as possible. Your funds may still be in the conversion stage, in which case they can be returned to you.

While you’re here: Subscribe to our newsletter for the latest tips, deals and news. It only takes a few seconds and we respect your privacy: