Not all business cards are created equal. Find out why American Express is ahead of the pack.

As a business owner, you’re probably always looking for ways to save time and money. And while there are loads of products and services out there jostling for your attention, it can be hard to cut through the noise.

A business credit or charge card can be an easy way for business owners and ABN holders to earn lucrative rewards on everyday spend, keep track of expenses and gain access to plenty of perks.

But how do you choose the card that’s right for your business? Above and beyond a juicy sign-on bonus, those in the know look for perks that save time and money in the long run.

American Express cards boast a range of compelling features designed to reward business owners and sole traders for each and every dollar spent.

So, if you’re currently running all your business spend on a debit card attached to your bank account, it could be time to re-think your strategy.

Is an American Express business card worth your while? We break down the key benefits.

1# Pocket a hefty serve of sign-on bonus points

Credit card providers are pumping out offers to entice Australian business owners. But when it comes to new cardholder sign-on bonuses, American Express is well and truly ahead of the pack.

2# Earn piles of points (uncapped) on every dollar of spend

A hefty sign-on bonus can be enticing.

However, when you run a business, it’s important to look beyond the initial sweetener for a competitive ongoing point earn rate on everyday purchases.

Amex business cards shine in this regard, delivering some of the highest earn rates available. Plus, there’s no cap on the points you can earn each month or each year, so you can turbocharge points earn for your business.

These three Amex business cards deliver points on everyday spend:

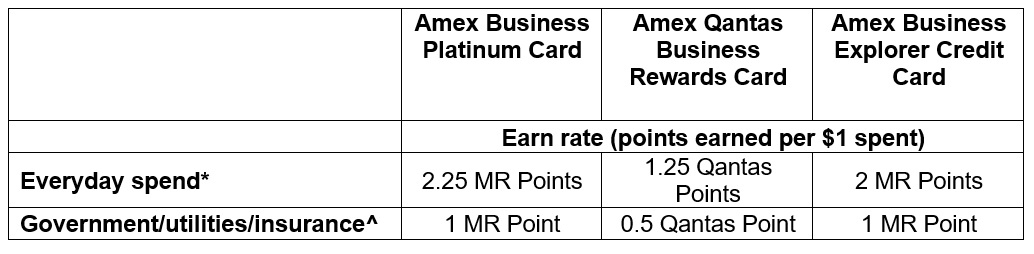

Take out one of Amex’s three most popular business cards, and you’ll effectively earn on each and every dollar you spend on your card. Earn rates for these three cards are highlighted in the table below:

*Does not include annual fees, late payment fee and fees and charges for foreign currencies

^Participating merchants classified as “utilities” include gas, water and electricity providers; “Government” includes the Australian Taxation Office, the Australian Postal Corporation, federal/state and local government bodies; and “insurance” excluding insurances offered by American Express.

Plus, there’s no cap on the number of points you can earn.

Unlike many other business cards, Amex offers uncapped points earning potential, too. If you run a business with significant monthly expenses, uncapped points earn is particularly attractive.

So, whether you spend $3,000 or $300,000 per month, you’ll be earning points on each and every dollar you put through your card.

3# Access no pre-set spending limit

With American Express, depending on your circumstances, you can choose from a range of business ‘charge’ cards such as the Platinum Business and Qantas Business Rewards, which see business owners access no pre-set spending limit.

Having no pre-set spending limit helps many businesses to effectively manage monthly cashflow. It can also assist with managing large expenses.

How does it work? No pre-set spending limit could enable you to access a much higher monthly spending limit than if your business was to hold a standard credit card with a fixed limit. By demonstrating that you have the funds to pay off your balance, Amex could provide you with a line of credit in the hundreds of thousands of dollars, to support your business to grow.

Charge cards differ from a standard credit card in that the balance needs to be paid off in full every month. In doing so, you’ll avoid incurring any interest charges for your business.

RELATED: Discover featured business credit and charge cards

Bear in mind that while there’s no pre-set spending limit, this doesn’t mean you or your business can spend whatever you like. Your ‘hard’ limit could change from month to month, and it will largely depend on your spending habits.

4# Amplify your points earning potential with complimentary additional cardholders

It’s not uncommon for business cards to offer additional cardholders – but many do so at a fee.

With an Amex business card, employees can be issued with employee business cards at no extra cost, so you’ll earn rewards for your business faster.

In fact, depending on the Amex business card you choose, it’s possible to obtain up to 99 additional cards per account for free.

The additional cards are backed up with monthly statements which set out the individual expenditure by cardholder, making it easy for you to keep track of spend.

5# Full integration with MYOB

AMEX business Card accounts can be synced to MYOB, saving your business (and accountant) headaches at tax time. If you prefer not to have transactions automatically synchronised into your business books, you can import them into MYOB manually.

Prefer to import your transactions manually? Card transactions can also be imported manually into Quicken and Microsoft Excel.

6# Wider acceptance than you might think

If you’re currently running all your business spend on a debit card, Visa or Mastercard, you might be worried about American Express acceptance rates.

The fact is, Amex is widely accepted at merchants across Australia, and acceptance is growing by the day. Simply put, there’s no shortage of places you can use your card.

Even if your suppliers don’t accept Amex, you can earn points by paying your business expenses through payment portals such as RewardPay and B2BPay.

7# Annual Card fee may be Tax-deductible

American Express business cards come with an annual fee which differs between card products.

The annual fee may be tax-deductible if you use your card entirely for business purposes. You should speak with your accountant to determine the deductibility of this expense.

Verdict

Whether you’re a business owner or a sole trader, choosing American Express could earn you piles of points.

Plus, with a swag of bonus points on the table with a new Amex business card, there’s a compelling opportunity to maximise your points earn right now.

Created in partnership with American Express.

Fees, charges and Terms and Conditions apply. All information is correct as at 4 June 2020 and is subject to change. Cards are offered, issued and administered by American Express Australia Limited (ABN 92 108 952 085).

While you’re here: Subscribe to our newsletter for the latest tips, deals and news. It only takes a few seconds and we respect your privacy: