Disclaimer: The Champagne Mile holds no commercial relationship with Qantas Health Insurance. Before deciding to take up this product, you should assess your individual needs when considering whether Qantas Insurance inclusions suit your personal circumstances.

When it comes to health Insurance, Qantas Frequent Flyer isn’t likely to be top of mind.

But for those seeking a pile of Qantas Points, Qantas Health Insurance premiums allow you to sign up to Qantas Frequent Flyer for free, and earn a lucrative surge of bonus points by doing so.

Looking to learn more? Read on to discover our comprehensive post on all things Qantas Health Insurance, including how to join, select the best coverage for you, and earn ongoing Qantas Points.

A guide to Qantas Health Insurance

Qantas Health Insurance (previously known as Qantas Assure) is issued by nib, which is one of Australia’s largest health funds. Signing up for a policy can protect you from getting caught out, should life throw unexpected hospital fees your way.

This guide will walk you through all you need to know about Qantas Health Insurance, including the different types of cover and how to earn a lucrative sign-up bonus.

What is Qantas Health Insurance?

Qantas Health Insurance offers a wide range of hospital and extras policies while rewarding members for being policyholders and living a healthy lifestyle.

Large sign-up bonuses and various ways through which to earn Qantas Points mean that policy holders can boost a Qantas Frequent Flyer balance fast, with the added benefit of being protected by health insurance.

The different types of cover are Singles, Couples, Family and Single Parent.

Why join?

Life can throw unexpected curveballs, and health insurance can help to provide reassurance. Medical bills can exceed what many people can afford. Depending on the policy you sign up for, private health insurance may be able to take some financial stress off the cost of hospital services.

Additional ‘Extras’ cover can also lower the cost of allied health if you use rehabilitative or preventative health care services regularly. This kind of health cover can cover some of the cost of physio, chiro, dental and optical expenses.

Qantas Health Insurance premiums allow you to sign up for Qantas Frequent Flyer for free and earn a lucrative surge of bonus points by doing so.

How to sign up

The sign-up process is quite involved. Given your policy will depend on your personal situation and that of your partner or any family members you wish to include in your policy, there are a few more details to fill out than usual.

You can sign up online at qantas.com with these steps:

- Visit Qantas Health Insurance

- Click ‘Get a Quote’

- Fill in the ‘About You’ section by entering your name, date of birth, type of cover (e.g. Family), where you live, annual income bracket and if you are switching insurers

- Select your chosen level of Hospital cover and nominate an excess

- Select your chosen level of Extras cover

- Review your policy and proceed to the check-out

- Make your payment to finalise your new Qantas Health Insurance premium.

Sign in to your Qantas Frequent Flyer account to view your policy and confirm your sign-up bonus.

Earning Qantas Points with Qantas Health Insurance

This is where Qantas Health Insurance ties into the Qantas Frequent Flyer program, unlocking multiple ways to earn Qantas Points.

Welcome bonus when you take out a new policy

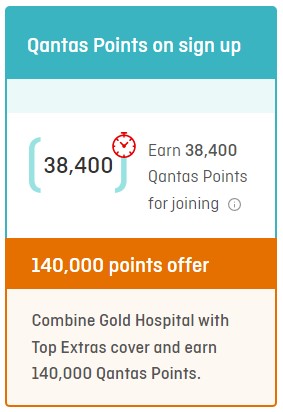

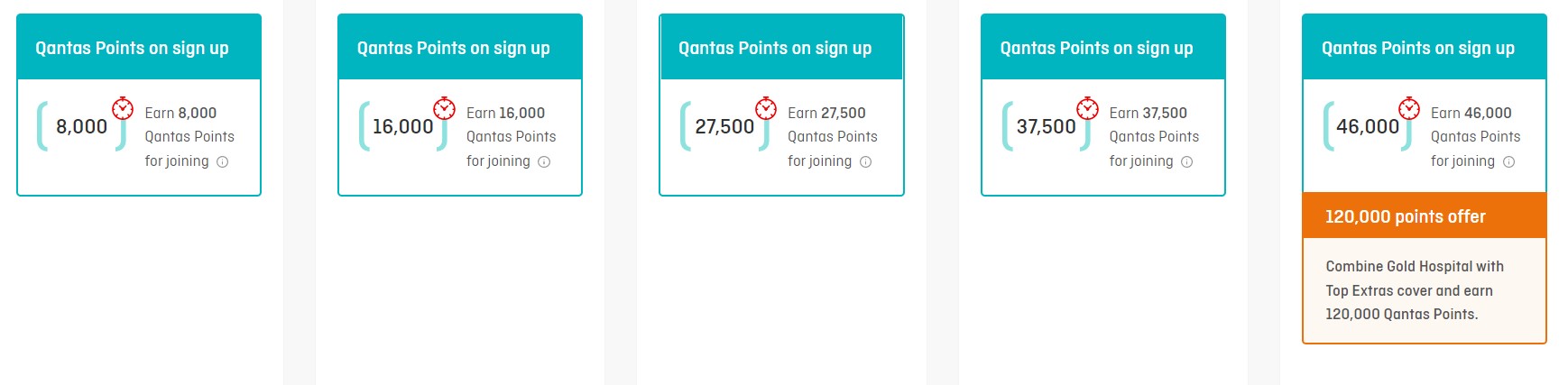

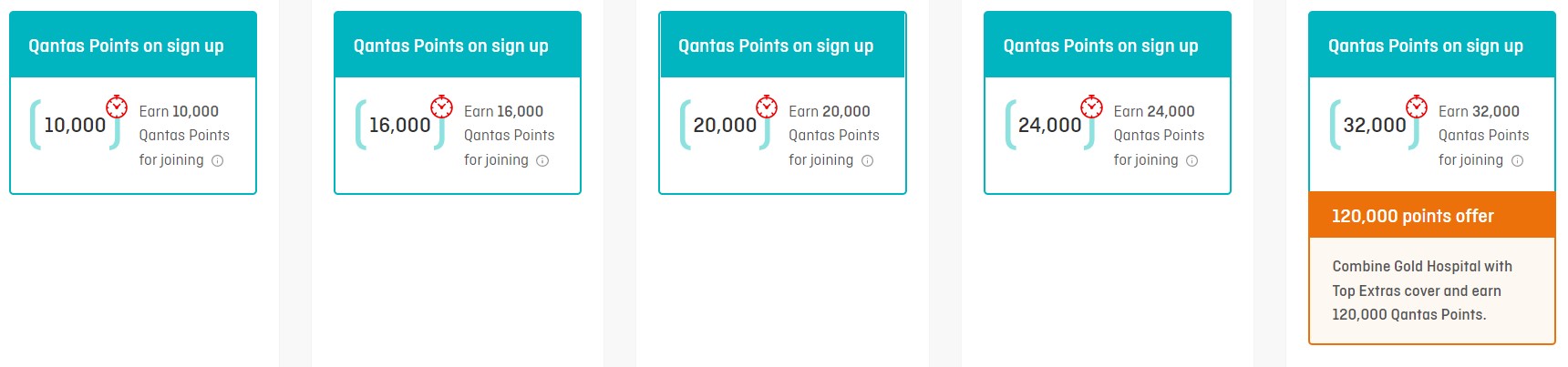

The most lucrative way to earn Qantas Points with Qantas Health Insurance is through a generous sign-on bonus for new members.

To unlock this bonus, members must meet certain conditions, such as being a new member and holding the policy for a minimum of 60 days.

Keep in mind that this is a particularly generous offer. In the past, bonus sign-on offers have usually sat at around the 120,000 Qantas Points mark. Either way, keep an eye out for that orange box.

After you’ve served out your sixty days, there is no need to hold onto the policy ongoing, hence why this can be a strategic way to earn a large sum of points.

We will be sure to continue updating you with the latest Qantas Health Insurance points offers – watch this space.

Earn 1 Qantas Point per $1 spent

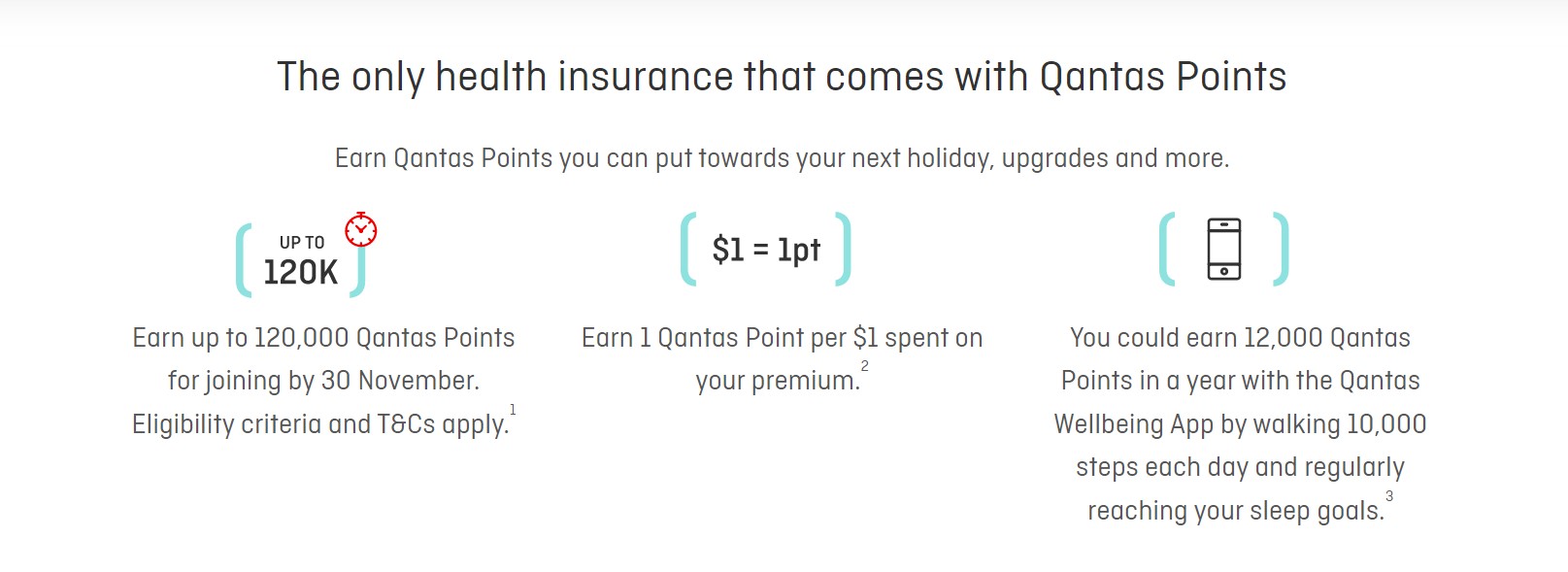

The second way to earn Qantas Points is by paying for your Qantas Health Insurance premium.

You will earn 1 Qantas Point for every dollar spent on the premium, which for top-level Family cover can amount to over 7,000 Qantas Points per year.

Earn Qantas Points via the Qantas Wellbeing App

Taking part in challenges via the Qantas Wellbeing App can see Qantas Health Insurance holders (including Qantas Life Insurance and travel insurance) earn even more Qantas Points.

Qantas Frequent Flyers who hold a current Qantas Health Insurance product will be capable of earning up to 20,000 Qantas Points through the app each year. This represents a much higher Qantas Points earn rate when compared to Qantas Frequent Flyer members who don’t hold a policy.

For example, Qantas Insurance holders will wake up to 5 points after hitting their sleep challenge goals (that’s over 1,800 points per year), compared to non-policyholders who will only earn 0.5 points each night.

Holding a Qantas Health Insurance policy can help to keep Qantas Points current and prevent them from expiring.

What does Qantas Health Insurance cover?

Qantas Health Insurance offers a large selection of policies that cater to different needs. Essentially, there are two kinds of cover – Hospital and Extras – each with policies that cover varying services. You can choose to combine Hospital and Extras cover or opt for one or the other.

Typically, the higher the policy cost, the more it covers. While the top-level combined policies attract the highest sign-up bonuses, it’s important to review the inclusions to make sure that they make sense for your personal circumstances.

Qantas Health Insurance Hospital cover

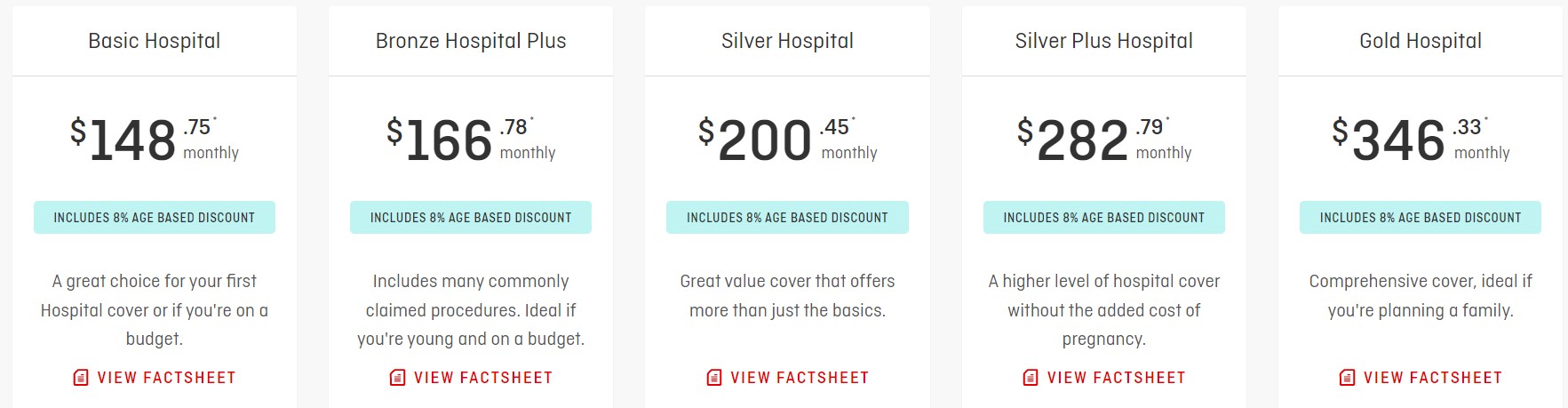

You can find a detailed list of benefits in the product disclosure statement (PDS) located on the Qantas Health Insurance website. Below is a quick summary of Hospital cover. The five policies are:

- Basic Hospital

- Bronze Hospital

- Silver Hospital

- Silver Plus Hospital

- Gold Hospital

While Basic Hospital covers a range of services and medical treatments like emergency ambulance, tonsil procedures, dental surgery and accidental injury — possibly suitable for young people with typically fewer health problems — reproductive services, pregnancy and birth cover don’t kick in until Gold Hospital cover. So, if you’re young, fit and healthy, you still may see the benefits of taking out top-level Gold Hospital cover if you’re planning to expand your family.

When weighing up which policy is right for you, it’s important to consider whether any pre-existing health conditions you have are covered. For example, insulin pumps are not covered unless you take out Silver Hospital cover or above, which could be important for a diabetic to consider.

Qantas Health Insurance Extras cover

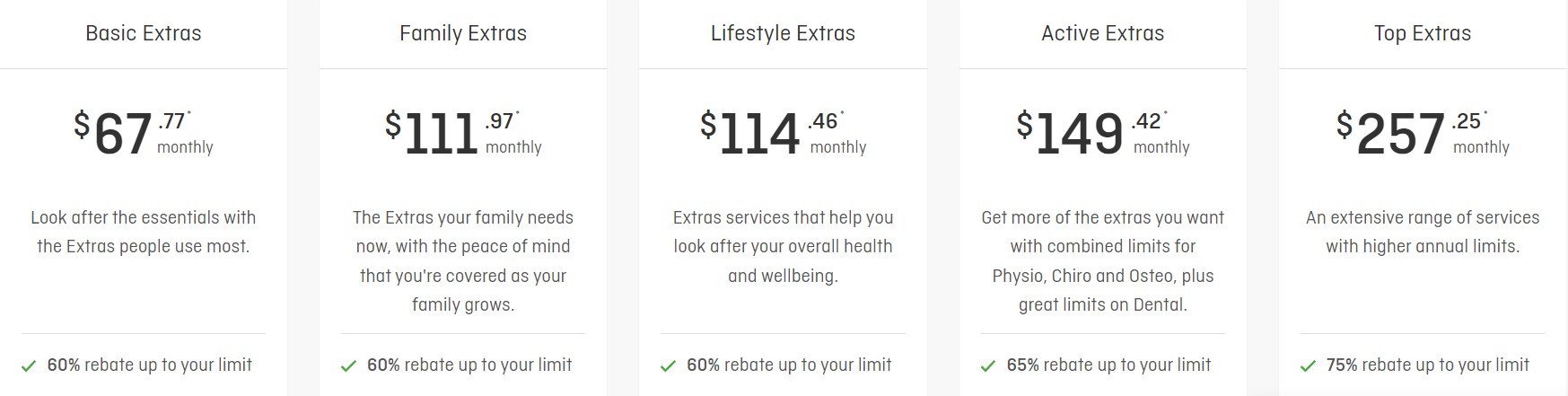

There are also five levels of Extras cover to consider. Not unlike Qantas Health Insurance Hospital cover, services increase with each level of cover. The five levels of Extras cover are:

- Basic Extras

- Family Extras

- Lifestyle Extras

- Active Extras

- Top Extras

While Basic Extras provides a 60% rebate (up to your annual limit caps) on a limited range of services, Top Extras gives back 75% of the medical bill (capped) and covers the full range of allied health services.

When assessing different covers be sure to look out for the types of extras and limits on claiming. You can find the full list of Extras benefits located in the PDS.

How does Qantas Health Insurance stack up?

When considering whether Qantas Health Insurance is the right option for you, it’s important to weigh up the costs and benefits against that of other insurance products, and whether the benefit of bonus Qantas Points is worth any additional cost.

If you’re a Qantas Frequent Flyer member who collects Qantas Points, the sign-up bonus could make Qantas Health Insurance a worthy option.

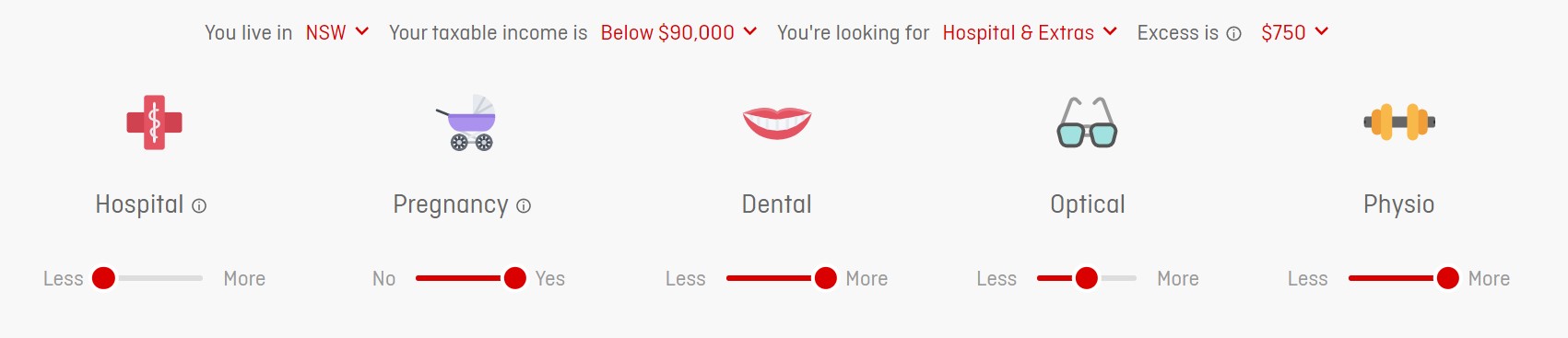

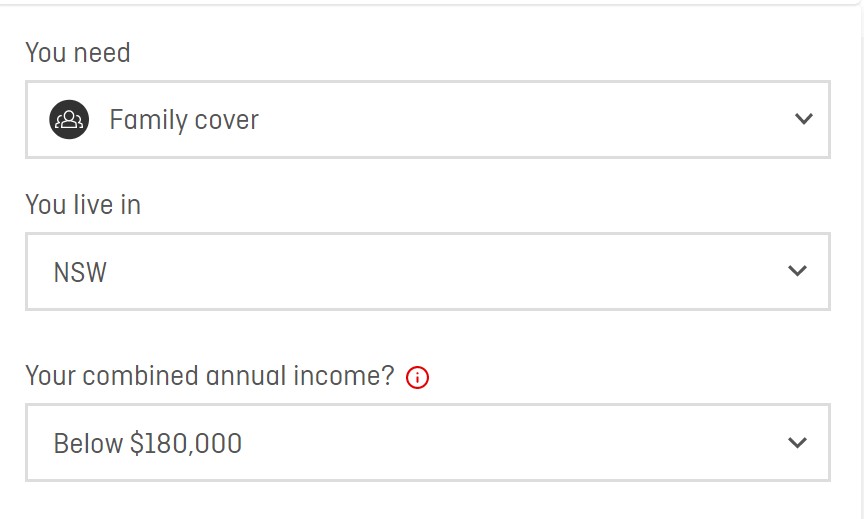

It’s worth noting that the premiums vary depending on whether you’re opting for Single, Couples, Families, or Single Parents cover, where you live and your annual income.

Here’s how much it could cost a couple living in NSW with a combined annual income of below $180,000 to get the top Family health insurance for a month.

In this case, Gold Hospital cover costs $346.33 AUD per month, while Top Extras costs an additional $257.25 AUD, meaning this combined policy will cost $603.58 per month.

This means staying covered for the 60 days it takes to receive the bonus points (when offered) with a Qantas Points sign-up bonus will cost just over $1,200.

We’d typically value Qantas Points at 1 cent each, which means you’d essentially be paying 1 cent per point with the added benefit of two months’ health insurance on the side.

Qantas Health Insurance appears to offer reasonably good value here. A top-level cover Bupa quote for a couple with the same circumstances shows cover would cost $345.78 per month for hospital cover and $260.37 per month for extras.

However, this brief assessment does not take into consideration the treatments and services covered. It is important to read the relevant policy booklets when determining which insurance is the best fit for you.

The fine print: what to know

Even when included in your policy, there are some instances where treatment is not covered by Qantas Health Insurance. While this remains somewhat standard across all private health insurers, it is worth looking out for. Here’s what to be across:

Pharmaceutical Benefits Scheme (PBS) medications are not covered in Hospital policies, however, non-PBS prescriptions may be covered by selected Extras policies.

2 and 6-month waiting periods for Extras services may be waived if you take out combined Hospital and Extras cover, however, this offer generally excludes all Hospital services waiting periods. Extras treatments within your waiting period are usually not eligible for claims.

Non-essential treatments such as cosmetic surgery will usually not be covered. Qantas Health Insurance only covers medically necessary treatments.

Services by non-approved providers will not be covered. Only treatments by registered providers in accredited rooms can be claimed.

Sign-up bonuses are not available to customers who have held a health insurance policy with some other health insurers who are aligned or partnered with Qantas within the last six months. This includes nib health funds such as AAMI, APIA, GU health or Suncorp.

It is also important to note that sign-up bonuses and waiting period offers are only available if you buy your policy directly through the Qantas website or when you sign up via the call centre.

How to contact Qantas Health Insurance

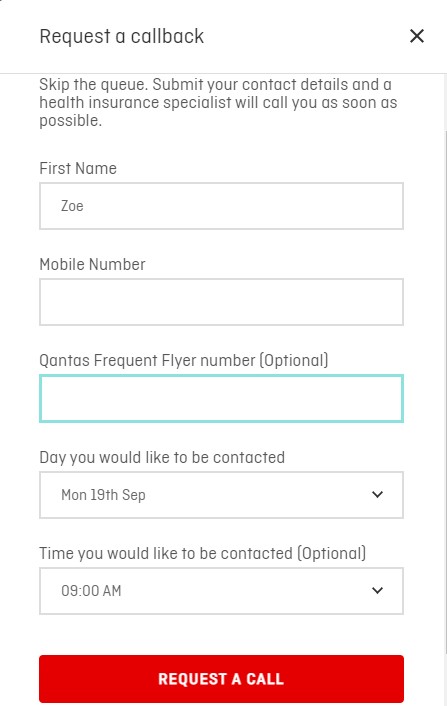

You can contact Qantas Insurance by calling 13 49 60. Alternatively, you skip the queue by either submitting a callback request or using the Live Chat.

Call Qantas Insurance on 13 49 60, or go online to Live Chat or submit a callback request.

Summing up: Is Qantas Health Insurance worth it?

With upwards of 100,000 Qantas Points on offer for those who hold a top policy for just 60 continuous days, Qantas Health Insurance could be a lucrative way to boost your Qantas Points balance, providing the insurance meets your needs.

Qantas Health Insurance can also be a strategy to score a significant number of points that will count towards qualifying for Qantas Points Club.

However, to earn the highest sign-on bonus points, bear in mind that you’d need to hold a combined Gold Hospital and Top Extras Cover. While this might make sense in the short term, if you choose to hold the health insurance for 12 months, that represents a significant cost outlay (possibly over $7,000). These high fees may not be worth it, particularly if you shop around and can find a cheaper policy for your long-term needs.

FAQ – Qantas Health Insurance

How do I earn bonus points with Qantas Health Insurance?

New customers can earn Qantas Points by signing up, maintaining cover for 60 continuous days, spending money on your premium and completing challenges via the Qantas Wellbeing App. The number of points you earn depends on your cover type, with higher premiums typically fronting more points.

Who is Qantas Health Insurance underwritten by?

Qantas Health Insurance is underwritten by nib Health Insurance. Nib underwrites Suncorp, AAMI Health APIA and TAL too.

How do I sign up for Qantas Health Insurance?

Simply follow steps 1-7 in this guide, starting by visiting the Qantas Health Insurance website and clicking ‘Get a Quote’.

Is Qantas Health Insurance different from Qantas Assure?

No. Qantas Health Insurance was initially launched as Qantas Assure and provides the same service.

While you’re here: Subscribe to our newsletter for the latest tips, deals and news. It only takes a few seconds and we respect your privacy: