Receive 200,000 Bonus Membership Rewards Points¹ with the American Express Platinum Card.

The bonus points are awarded when you apply online by 25 August 2026, are approved and spend $5,000 on eligible purchases on your new American Express® Platinum Card within the first 3 months. T&Cs apply. New American Express Card Members only.

Visit the secure, mobile-friendly application form on the Amex website via the button below.

Beyond the bonus points, enjoy a range of travel and lifestyle benefits, including:

- $450 Travel Credit each year to spend on flights, hotels or car hire via American Express Travel¹⁰

- Up to $400 in Dining Credits each year until 31 Dec 2026 ($200 to spend at participating restaurants in Australia and up to $200 to spend at participating restaurants abroad, enrolment required)¹¹

- ALL Accor+ Explorer membership (valued at $349 p.a). Receive two complimentary nights stay each year (each must be booked in conjunction with a paid night), 30% off dining (for up to 10 guests at over 1,600 participating restaurants), and more⁶

Unpacking the Amex Platinum Card offering

The American Express Platinum Card carries a reputation for substance as well as style.

Made from metal, it comes with 200,000 Membership Rewards Points¹ for new Amex Card Members, enough to bring that next holiday within reach.

Membership Rewards points can transfer into a wide choice of partners: over ten airline and hotel programs including Qantas and Virgin Australia, plus Marriott Bonvoy and Hilton Honors. They can also be redeemed for purchases or for travel booked through American Express Travel.

The $1,450 annual fee comes with a suite of travel and lifestyle benefits designed to give back more than you spend, if you use them well.

Enjoy unlimited Virgin Australia Lounge access (worth $549 AUD in the first year)

Primary Card Members can enjoy unlimited access to Virgin Australia’s network of domestic lounges when flying with Virgin Australia. You can also bring in a guest travelling with you.⁸ A 12-month Virgin Australia lounge membership normally costs $549 for the first year.

Get two Priority Pass memberships (worth $858 USD)

Whether you travel for business or leisure, airport lounge access is a handy perk that will allow you to relax in comfort before your flight. The American Express Platinum Card delivers premium benefits here, with a complimentary Priority Pass membership for the primary Card Member and one nominated additional Card Member.⁸

Each Priority Pass member can also invite one accompanying guest into the lounge at no additional cost (this is valued at US$32 per person, per visit).

Priority Pass operates many Airport Lounges around the world and boasts an extensive footprint in Australia. A Priority Pass membership also unlocks many lounges overseas.

Purchasing a prestige Priority Pass membership would normally set you back $429 USD per person (or $858 USD for the two memberships available to each American Express Platinum Card Member). So, simply by using this benefit, you can extract significant value from your card.

Plus, access other worldwide lounges

In addition, the American Express Platinum Card unlocks unlimited access to a range of other highly regarded Airport Lounges.⁸ These include:

- American Express branded Lounges, and The Centurion® Lounge at Sydney International Airport and Melbourne International Airport. There is also the ability to utilize premium international Amex Centurion Lounges internationally at airports including Hong Kong and San Francisco.

- Plaza Premium Lounges, and

- Delta Sky Club Lounges when travelling on Delta.

Entry requirements and guest allowances may vary.

Note: Card Members must present their physical eligible card to gain entry to the lounge.

Get a $450 AUD Travel Credit each year

American Express Platinum Card Members receive a $450 Travel Credit each year.¹⁰ This flexible credit can be used to book flights, accommodation or car rental with American Express Travel.

You can use it for yourself or someone else and it can be booked either online with Amex Travel or over the phone – it’s up to you.

You will need to use your annual $450 Travel Credit on a single travel booking of $450 or more on your eligible Card, made through American Express Travel Online. Your booking will be charged in full to your American Express Platinum Card and American Express will then credit $450 to your Account within 3 business days but may take up to 30 days. You will still receive your $450 Travel Credit each year, and your Travel Credit anniversary will remain the same.

Enjoy up to $400 AUD Global Dining Credit

Enjoy up to $400 per calendar year when you dine from a curated collection of over 2,000 restaurants in 20 countries. That’s up to $200 to spend at participating restaurants in Australia and up to $200 to spend at participating restaurants overseas.¹¹

In Australia, there are over 100 restaurants to choose from across seven states and territories. Local eateries include Bentley, Quay, Vue de Monde, Africola and Cutler and Co.

Internationally, the Global Dining Credit can be used at many flagship restaurants, all of which are fit for the bucket list. Think L’Atelier Saint-Germain de Joël Robuchon, La Dame de Pic, Raffles Singapore, and even the possibility of sipping bellinis at Harry’s Bar at the Cipriani, Venice.

A separate one-time enrolment is required for each credit. The Benefit will expire on 31 December 2026.

Obtain complimentary ALL Accor+ Explorer membership (valued at $349 p.a.)

ALL Accor+ Explorer unlocks one of Asia Pacific’s most extensive travel and dining programs.

Each year, receive two ‘Stay Plus’ complimentary nights stay (each complimentary night must be booked in conjunction with a paid night) at over 1,300 participating hotels in Asia Pacific.

Fastrack to instant Gold Accor Live Limitless status with a bonus 30 status nights, enjoy 30% off dining, for up to 10 guests at over 1,600 participating restaurants and 15% off drinks in Asia Pacific.⁶

Accor boasts an extensive portfolio of premium properties in Asia Pacific, with many participating hotels in Australia. This includes a range of five-star Sofitel, Pullman and MGallery properties.

Even if you travel infrequently, an ALL Accor+ Explorer membership can offer significant savings.

Unlock elite status with leading hotels

Obtaining elite tier status with a hotel loyalty scheme usually requires many stays and a significant spend outlay.

However, the American Express Platinum Card provides instant, fast-tracked elite membership across multiple programs, including:

- Hilton Honors Gold Status: Hilton operates over 500 properties worldwide⁴

- Marriot Bonvoy™ Gold Elite Status: Over 6,500 properties come under the Marriott umbrella³

- Radisson Rewards Premium Status⁵

The benefits on offer vary between programs but may include room upgrades, early and/or late checkout (subject to availability), breakfast (at selected Hilton properties) welcome amenities and free internet access.

These perks can add significant value for money when you travel.

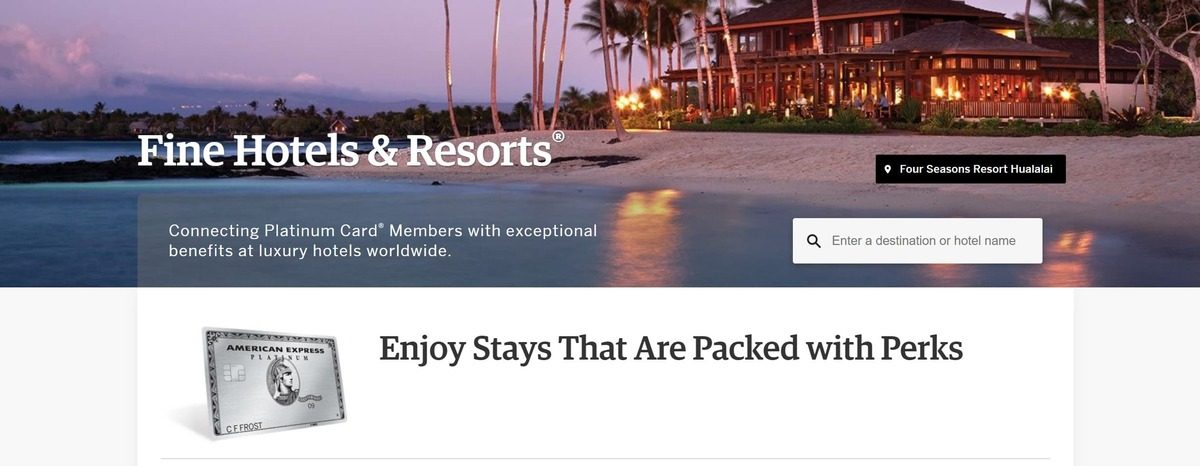

Access American Express Fine Hotels + Resorts benefits

Receive a complimentary suite of benefits at over 1,600 extraordinary properties worldwide when you book with Fine Hotels + Resorts.20

Complimentary benefits offered through the program include:

- daily breakfast for two people

- room upgrades when available

- noon-check in when available and guaranteed 4 pm late check-out, and

- a special amenity at each property (this is often a $100 USD room credit that can be used towards eligible spend at the property).

Participating properties can be found in many locations within Australia.

Amex states that the complimentary benefits on offer here average a total value of more than $550 USD for one two-night stay7 so there is significant value to be obtained here.

Stay informed with The Australian Premium subscription

American Express Platinum Card members and additional card members can stay informed with The Australian Premium subscription.¹⁴

The benefit provides access to news coverage and analysis from Australia and around the world across all your devices as well as access to The Wall Street Journal. In addition, access exclusive member-only features including a weekly curated eNewsletter featuring The Australian and global news partners including The Times of London and Harvard Business Review.

The complimentary digital subscription to The Australian Premium is available to American Express® Platinum, Platinum Business, Corporate Platinum, and Qantas Corporate Platinum Card Members, including Additional and Employee Card Members.

Grow your points balance with everyday spend

The American Express Platinum Card offers a flat 2.25 points per $1 for all spend, except with government bodies where you’ll earn 1 point per $1.²

There’s no cap on how many points you can earn each month or year. And with American Express widely accepted at merchants across Australia, there’s no shortage of places you can use your Card.

American Express Platinum Card Insurances

The Amex Platinum Card offers a suite of complimentary insurances.¹³ Depending on your circumstances, one or more of these products could come in handy when you’re shopping at home, or perhaps travelling overseas.

The complimentary insurances that you can access through the Card include:

- Domestic and International Travel insurance (this includes points redemption bookings redeemed via your card)

- Loss Damage Waiver cover

- Medical emergency expenses cover, including repatriation

- Personal Liability cover

- Card Purchase Cover

Card Members also get access to Smartphone Screen Cover, which provides $500 towards front screen repairs if you accidentally break your smartphone screen, with a 10% claim excess (a claim limitation of twice per year).

Before deciding to take up any of these insurance products, and to find out more information about coverage requirements, you should refer to the card PDS and terms & conditions on the Amex website.

Other American Express Platinum benefits

The American Express Platinum Card unlocks plenty of other benefits designed to offer additional value. There are too many to cover here in full, but they include:

- International Airline Program:¹⁷ Save up to 20% on First and Business Class fares with some of the world’s leading airlines such as Qantas Airways, Virgin Australia and more.

- Up to four additional cards for family members at no charge.¹² The points earned are credited to your account and additional Card Members will be able to access many of the exclusive perks we’ve covered above).

- Amex Experiences App:¹⁵ Get access to a 24/7 Premium Concierge service in your pocket, where you can access information on Platinum benefits, travel offers, events and recommended merchants.

- Amex offers:¹⁶ Access cashback and bonus offers from within your Amex Account.

Read on to learn how this card is packed with perks for business and leisure.

Charge Card with flexible spending power

The American Express Platinum Card is a Charge Card and it offers up to 44 cash flow days.¹⁸

Unless Amex tells you otherwise, your American Express Charge Card comes with flexible spending power, also known as no-pre-set spending limit. This means that the amount you can spend is dynamic and can adapt based on your transaction patterns, your businesses credit rating and other factors. The way you use your Card can help your spending power grow, particularly in the first few months. To help maximise your spending power, you can make regular transactions and don’t miss any payments.

American Express Platinum Card annual fee and eligibility

The American Express Platinum Card comes with an annual fee of $1450.

To apply for the Card, you’ll need to be 18 years or older, and have a good credit history and no payment defaults. New American Express Card Members only.

You must be an Australian citizen or permanent resident or hold a long-term visa. Long-term means 12 months or more and does not include a student visa.

To be eligible for the bonus points, you must not currently hold or have held a card issued directly by American Express Australia in the last 18 months.

Note that you are eligible if you hold an Amex corporate card or if you are an additional card member on someone else’s primary account.

Don't miss 200,000 Bonus Membership Rewards Points with the Amex Platinum Card

Receive 200,000 Bonus Membership Rewards Points when you apply online by 25 August 2026, are approved and spend $5,000 on eligible purchases on your new American Express® Platinum Card within the first 3 months. T&Cs apply. New American Express Card Members only.

The secure, mobile-friendly application form should take less than 10 minutes to complete and Amex will give you a response in approximately 5-10 working days.

American Express income and credit approval criteria applies. Subject to Terms and Conditions. Fees and charges apply. All information, including fees and charges are correct as at 2 October 2024 and are subject to change. Applicants must be 18 years of age or over to apply for the American Express Platinum Card. They must be an Australian Citizen or permanent resident or hold a long term visa. Long term means 12 months or more and does not include a student visa.

- Bonus & Eligibility. 200,000 Bonus Membership Rewards® Points are only available to new American Express Card Members who apply online by 25 August 2026, are approved and spend $5,000 or more on eligible purchases on your new Card in the first 3 months from the Card approval date. Eligible purchases do not include Card fees and charges, for example annual fees, interest, late payment, cash advances, balance transfers, traveller’s cheques and foreign currency conversion. Please allow 8-10 weeks for the bonus points to be credited to your Account after the spend criteria has been met. Card Members who currently hold or who have previously held any Card product issued by American Express Australia Limited in the past 18 months are ineligible for this offer. The American Express Platinum Card has an Annual Card Fee of $1,450. This advertised offer is not applicable or valid in conjunction with any other advertised or promotional offer.

- Subject to the Terms and Conditions of the Membership Rewards program available here. You will earn 1 point per dollar spent with Merchants classified as ‘government’, including the Australian Taxation Office, the Australian Postal Corporation (Australia Post), Federal/State and Local Government bodies, including where you use a payment account, payment aggregator, services of a third party or online retailers that sell goods for another merchant.

- As a Platinum Card Member you are eligible to enrol in complimentary Marriott Bonvoy(TM) Gold Elite Status. Once you request enrolment within the Marriott Bonvoy Program at the Gold Elite Status level, American Express will share your enrolment information with The Marriott Bonvoy(TM) Program. Marriott Bonvoy may use this information in accordance with its privacy statement available at www.marriott.com/privacy . You will maintain Gold Elite Status without meeting otherwise required Marriott Bonvoy criteria as long as you remain an eligible American Express Card Member or until American Express notifies you that the benefit is terminated. Marriott Bonvoy member benefits are subject to change, availability and certain eligibility requirements. Reservations booked through third parties and online booking sources are not eligible. For complete Marriott Bonvoy Program terms visit marriott.com. Marriott Bonvoy program amenities may not be combined with the Fine Hotels + Resorts program. Upgrades are based upon availability and will vary by property.

- As a Platinum Card Member you are eligible to enrol in complimentary Hilton Honors Gold status. Please note that a Hilton Honors Membership Number is required before you are able to enrol in this benefit. For Card Members who are new to Hilton Honors, please sign up here. Your full name and email address must match on both your American Express account and Hilton Honors account to successfully complete your registration. Offer available only to Platinum Card Members and is not transferable. Full details of Gold status can be found at Member Benefits, and are subject to change by Hilton. Gold status benefits are subject to availability at participating hotels and resorts within the Hilton Portfolio. Once you request enrolment in Hilton Honors Gold status, American Express will share your enrolment information with Hilton. Hilton may use this information in accordance with its privacy policy available at Hilton.com/PrivacyPolicy. If you already have Hilton Honors Gold Status, you can maintain the benefit in the future because you don’t need to meet any stay requirements. You maintain Gold status without meeting otherwise required criteria only while an eligible cardholder or until American Express notifies you that the benefit is terminated. Hilton Honors membership, earning and redemption of Points are subject to Hilton Honors Terms & Conditions. All Hampton by Hilton™ hotels in the Republic of China are excluded from the Hilton Honors program. Visit HiltonHonors.com/Terms for more details.

- Enrolment in the Radisson Rewards program is required for membership to be upgraded. Benefits are subject to change and availability may vary by property. Radisson Rewards benefits may not be combined with benefits offered by American Express and other loyalty programs. All American Express terms and conditions apply. All Radisson Rewards terms and conditions apply. To view terms and conditions visit Radisson Rewards Terms and Conditions. American Express reserves the right to instruct Radisson Rewards to cancel your membership if you cease to be a Platinum Card Member or your Account is not in good standing.

- An annual ALL Accor+ Explorer Membership is valued at AU$349, found

at accorplus.com/au/benefits as at 1 October 2025. Eligible American Express Card

Members are required to enrol to receive a complimentary ALL Accor+ Explorer

membership. An ALL Accor+ Explorer membership is available only to the Primary

Platinum Card Member. Membership privileges will only be granted on presentation of a

valid membership card and a member must identify themselves as an ALL Accor+

Explorer member at time of booking. Accommodation bookings must be made in

advance through the ALL.com app. American Express reserves the right to instruct

Accor Plus to cancel your membership if you cease to be a Platinum Card Member or

your Account is not in good standing. Complimentary membership is a continuing

benefit of your American Express Platinum Card, however American Express reserves

the right to discontinue the benefit, upon providing you with reasonable notice. Once

enrolled, enrolment continues for at least 12 months. If you become ineligible for this

benefit or if this benefit ends, the ALL Accor+ Explorer membership standard eligibility

criteria will apply to you. A Stay Plus Free Night may be subject to availability at

participating properties. Use of the Stay Plus is subject to the conditions as listed on

accorplus.com/au/terms-and-conditions. Membership privileges are subject to

exceptions listed at accorplus.com/au/benefits-exceptions. Dining and drinks

discounts do not apply to room service, mini bars, meeting rooms, selections from the

kids’ menus or takeaways; and public holidays or during special events. For more

information, please visit here: accorplus.com/benefits/more-flavours. Dining privileges

are subject to the Accor Plus membership terms and conditions which are found

here: accorplus.com/au/terms-and-conditions Average US$550 value based on FHR bookings in 2023 for stays of two nights. Actual value will vary based on property, room rate, upgrade availability and use of benefits. Certain room categories are not eligible for upgrade. US$100 credit varies by property. Valid only for new Fine Hotels + Resorts (FHR) bookings made through American Express Travel at participating properties. Special amenities, US$100 Credit and FHR benefits vary by property and some benefits are subject to availability. Credit is applied in US dollars or equivalent in local currency based on the exchange rate on the day of check-out. Unused credit will be forfeited at check-out. Bookings must be made using an eligible Card and must be paid using that Card, or another American Express® Card, in the eligible Card Member’s name, and that Card Member must be travelling on the itinerary booked. Participating Fine Hotels + Resorts properties and benefits are subject to change. Limit one benefit package per room, per stay. Three room limit per Centurion or Platinum Charge Card Member, per stay. For full FHR Terms and Conditions, please visit www.amex.com.au/fhr.

- The American Express Global Lounge Collection

- The Centurion® Lounge:

Platinum Card Members have complimentary access to all locations of The Centurion Lounge. Gold Card and Green Card Additional Cards on your Platinum account are not eligible for complimentary access. Card Members may bring up to two (2) companions into The Centurion Lounge locations in the U.S. and select international locations as set forth on the Centurion Lounge website at thecenturionlounge.com (the “Centurion Lounge Website”). Guest access policies (including, but not limited to, guest fees and number of complimentary guests per visit) applicable to international locations of The Centurion Lounge may vary by location and are subject to change. Visit the Centurion Lounge Website to learn more about lounge locations and guest access policies applicable to international Centurion Lounge locations. For more information on the Australian Lounges access, visit americanexpress.com.au/airportlounge. All access to The Centurion Lounge is subject to space availability. To access The Centurion Lounge, Platinum Card Members must arrive within 3 hours of their departing flight (during a layover Platinum Card Members may enter The Centurion Lounge in the connecting airport at any time) and present The Centurion Lounge agent with the following upon each visit: their valid Platinum Card, a boarding pass showing a confirmed reservation for a departing flight on the same day on any carrier and a government-issued I.D. Note that select lounges allow access to Card Members with a confirmed reservation for any same-day travel (departure or arrival). Refer to the specific location’s access policy for more information. Failure to present the above documentation may result in access being denied. Card Members must be at least 18 years of age to enter without a parent or legal guardian. All Centurion Lounge visitors must be of legal drinking age in the jurisdiction where the Lounge is located to consume alcoholic beverages. Please drink responsibly. American Express reserves the right to remove any person from the Lounge for inappropriate behaviour or failure to adhere to rules, including, but not limited to, conduct that is disruptive, abusive or violent. Soliciting other Card Members for access into our lounge is not permissible. Hours may vary by location and are subject to change. Amenities vary among The Centurion Lounge locations and are subject to change. Card Members will not be compensated for changes in locations, rates or policies. In addition to the complimentary services and amenities in the Lounge, certain services, products or amenities may be offered for sale. You are responsible for any purchases and/or servicing charges you make in The Centurion Lounge or authorise our Member Services Professionals to make on your behalf. Services available at the Member Services Desk are based on the type of American Express Card used to enter the Lounge. American Express will not be liable for any articles lost or stolen or damages suffered by visitors to The Centurion Lounge. If we in our sole discretion determine that you have engaged in abuse, misuse, or gaming in connection with lounge access in any way or that you intend to do so, we may remove access to The Centurion Lounge from the Account. Use of The Centurion Lounge is subject to all rules and conditions set by American Express. American Express reserves the right to revise the rules at any time without notice.

Escape Lounges – The Centurion® Studio Partner

This benefit is available to Platinum Card Members. Additional Gold Cards and Additional Green Cards on your Platinum account are not eligible for complimentary access. Card Members receive complimentary access to all US locations of the Escape Lounges. Card Members may enter with up to two complimentary guests. Card Member must present his or her valid Card, a boarding pass showing a confirmed reservation for same-day travel on any carrier and government-issued I.D. Card Member must be at least 18 years of age to enter without a parent or legal guardian. All Escape Lounge visitors must be of legal drinking age in the jurisdiction where the Lounge is located to consume alcoholic beverages. Please drink responsibly. Card Member must adhere to all house rules of participating lounges. Card Members and their guests will receive all of the complimentary benefits and amenities afforded to the Escape Lounge customers, including access to purchase non-complimentary items. Some product features may be subject to additional charges. Escape Lounge locations are subject to change. Additional restrictions may apply.

Delta SkyClub

Effective January 1, 2024: Eligible Card Members travelling on a same-day Delta-operated flight with Basic Economy (E) fare tickets will not have access to the Delta Sky Club or to Grab and Go.

This benefit is available to the Platinum Card Members. Platinum Card Members must present their valid American Express Card, government-issued I.D., and boarding pass to the Delta Sky Club ambassador. Boarding pass must show a reservation for a same-day Delta-operated flight (Delta or Delta connection) departing from or arriving at the airport in which the Delta Sky Club is located. Name on boarding pass must match name on the Card. Eligible Platinum Card Members on departing flights can only access the Delta Sky Club within three hours of their flight’s scheduled departure time. During a connection between Delta-operated flights on the same ticket, you may use the Delta Sky Club in your connecting airport at any time during the layover. Delta reserves the right to limit access for non-revenue flyers at any Delta Sky Club. Additional Gold Cards and Additional Green Cards on your Platinum account are not eligible for complimentary access. Access to Delta Sky Club partner lounges is not permitted. Individuals must be at least 18 years of age to access Delta Sky Club, and 21 years of age to access locations with a self-service bar, unless accompanied by a responsible, supervising adult who has access to the lounge. Eligible Card Members must adhere to all Delta Sky Club House Rules while accessing participating airport clubs. Participating airport clubs and locations subject to change without notice. Eligible Platinum Card Members may bring guests into the Delta Sky Club subject to the most current Delta Sky Club access and pricing policies, and must use their valid Platinum Card as the payment method for guest access. Guests must also be flying on a same-day Delta-operated flight. Guest access and fees subject to terms and conditions of participating airport clubs.

For the most current Delta Sky Club access and pricing policy, please visit delta.com/skyclubaccess. All Delta Sky Club rules apply to Delta Sky Club membership and use. To review the rules, please visit delta.com/skyclub. Benefit and rules subject to change without notice. Additional restrictions may apply.

Plaza Premium Lounges

This benefit is available to Platinum Card Members. Additional Gold Cards and Additional Green Cards on your Platinum account are not eligible for complimentary access. Card Members receive complimentary access to any global location of Plaza Premium Lounges. Card Member must present their valid Card, a confirmed boarding pass for same-day travel on any carrier and government-issued I.D. In some cases, Card Member must be 21 years of age to enter without a parent or guardian. Card Members may bring up to two (2) guests into Plaza Premium Lounges as complimentary guests. Card Member must adhere to all house rules of participating lounges. Card Members and their guests will receive all of the complimentary benefits and amenities afforded to the Plaza Premium Lounge customers, as well as access to purchase non-complimentary items. Some product features may be subject to additional charges. Plaza Premium Lounge locations are subject to change.

Virgin Australia

This benefit is available to Primary Platinum Card Members. Access is complimentary for Primary Platinum Card Members and one complimentary guest only. The Primary Platinum Card Member and guest must be travelling with Virgin Australia domestically on the same Virgin Australia flight. Access is to Virgin Australia-branded lounges at their city of departure in Australia only. The Platinum Card Member must present their valid Physical Platinum Card and same-day boarding pass to Virgin Australia lounge agents and the name on the boarding pass must match the name on the Platinum Card. The guest must also present their boarding pass. One guest per Primary Platinum Card Member permitted. All access is subject to space availability. Additional Gold Cards and Additional Green Cards on your Platinum account are not eligible for complimentary access. This benefit is subject to change.

Priority Pass™ – Platinum Personal Charge Card. This benefit is available to Platinum Personal Charge Card Members. Platinum Card Members and one Additional Platinum Card Member as nominated by the Primary Card Member may enrol in the Priority Pass™ program. Additional Gold Cards and Additional Green Cards on your Platinum account are not eligible for complimentary access. Priority Pass is an independent airport lounge access program. You acknowledge and agree that American Express will verify your Card Account number and provide updated Card Account information to Priority Pass. Priority Pass will use this information to fulfill on the Priority Pass program and may use this information for marketing related to the program. Once enrolled, Platinum Card Members whose Card Account is not cancelled may access participating Priority Pass lounges by presenting your Priority Pass card and airline boarding pass. If the Card Account is cancelled, you will not be eligible for Priority Pass and your enrolment will be cancelled. At any visit to a Priority Pass lounge that admits guests, you may bring in 1 guest for no charge. You will be charged the prevailing retail rate for any additional guests. Some lounges do not admit guests. In some lounges, Priority Pass member must be 21 years of age to enter without a parent or guardian. Priority Pass members must adhere to all house rules of participating lounges. Amenities may vary among airport lounge locations. Conference rooms, where available, may be reserved for a nominal fee. Priority Pass lounge partners and locations are subject to change. All Priority Pass members must adhere to the Priority Pass Conditions of Use, which will be sent to you with your membership package, and can be viewed at www.prioritypass.com. Upon receipt of your enrolment information, Priority Pass will send your Priority Pass card and membership package which you should receive within 10-14 business days. If you have not received the Priority Pass card after 14 days, please contact American Express using the number on the back of your American Express® Card. To receive immediate access to the lounges after enrolling in Priority Pass, you can activate your membership online by using your Priority Pass membership details to receive a Digital Membership Card. For a step-by-step guide on the activation process, visit prioritypass.com/activation.

Priority Pass™ – Platinum Business and Corporate Charge Cards. This benefit is available to Platinum Business and Corporate Charge Card Members. Platinum Card Members and one Employee Platinum Card Member as nominated by the Primary Card Member may enrol in the Priority Pass™ program. Additional Gold Cards and Additional Green Cards on your Platinum account are not eligible for complimentary access. Priority Pass is an independent airport lounge access program. You acknowledge and agree that American Express will verify your Card Account number and provide updated Card Account information to Priority Pass. Priority Pass will use this information to fulfill on the Priority Pass program and may use this information for marketing related to the program. Once enrolled, Platinum Card Members whose Card Account is not cancelled may access participating Priority Pass lounges by presenting your Priority Pass card and airline boarding pass. If the Card Account is cancelled, you will not be eligible for Priority Pass and your enrolment will be cancelled. At any visit to a Priority Pass lounge that admits guests, you will be charged the prevailing retail rate for any guests. Some lounges do not admit guests. In some lounges, Priority Pass member must be 21 years of age to enter without a parent or guardian. Priority Pass members must adhere to all house rules of participating lounges. Amenities may vary among airport lounge locations. Conference rooms, where available, may be reserved for a nominal fee. Priority Pass lounge partners and locations are subject to change. All Priority Pass members must adhere to the Priority Pass Conditions of Use, which will be sent to you with your membership package, and can be viewed at www.prioritypass.com. Upon receipt of your enrolment information, Priority Pass will send your Priority Pass card and membership package which you should receive within 10-14 business days. If you have not received the Priority Pass card after 14 days, please contact American Express using the number on the back of your American Express® Card. To receive immediate access to the lounges after enrolling in Priority Pass, you can activate your membership online by using your Priority Pass membership details to receive a Digital Membership Card. For a step-by-step guide on the activation process, visit prioritypass.com/activation.

Lufthansa

This benefit is available to Platinum Card Members. Additional Gold Cards and Additional Green Cards on your Platinum Card Account are not eligible for complimentary access. Platinum Card Members have complimentary access to select Lufthansa Business Lounges (regardless of ticket class) and Lufthansa Senator Lounges (when flying business class) when flying on a Lufthansa Group flight. To access the Lufthansa lounges, Platinum Card Members must present their valid Platinum Card, a government issued I.D., and a same-day departure boarding pass showing confirmed reservation on a Lufthansa Group flight (Lufthansa, SWISS and Austrian airlines). Card Members must adhere to all rules of participating lounges. Participating lounges and locations subject to change without notice. Additional guest access and fees subject to terms and conditions of participating lounges. In some Lounges the Platinum Card Member must be at least 18 years of age to enter without a parent or guardian. Must be of legal drinking age to consume alcoholic beverages. Please drink responsibly.

For the most current list of Lufthansa lounges, guest access requirements, rules, and pricing policy, please visit https://www.lufthansa.com/de/en/lounges.

Additional Global Lounge Collection Partner Lounges

American Express offers access to additional lounges in the Global Lounge Collection where Platinum Card Members have complimentary access to participating locations. Card Members must present their valid Platinum Card, a government-issued I.D., and a boarding pass showing a confirmed reservation for same-day travel on any carrier. Guest access and associated fees are subject to the terms and conditions of the participating lounge provider. Participation, locations, rates, and policies of lounges are subject to change without notice, and Card Members and their guests will not be compensated for such changes. Amenities, services, and hours may vary by participating lounge and are subject to change without notice. American Express and the participating lounge will not be liable for any articles lost or stolen, or damages suffered by the Card Member or guests inside the participating lounge. For participating lounges with a self-service bar, the Card Member may be required to be of legal drinking age in the participating lounge jurisdiction to enter without a parent or legal guardian. All Card Members and their guests must be of legal drinking age to consume alcoholic beverages. Please drink responsibly. Each participating lounge may have their own policy allowing for children under a certain age to enter for free with the Card Member who is a parent or legal guardian. Card Member must adhere to all house rules of participating lounges If American Express, in its sole discretion, determines that the Card Member or their guests have engaged in abuse, misuse, or gaming in connection with access to participating lounges in any way, or that the Card Member or their guests intend to do so, we may remove access to the Additional Lounges from the Account. American Express and the participating lounge reserve the right to revise the rules at any time without notice. For the most current list of participating lounges and access requirements, please use the Lounge Finder feature in the American Express App or visit www.americanexpress.com.au/platinumlounges.

- The Centurion® Lounge:

- If your Card has a Travel Credit benefit, the Primary Card Member is eligible for an annual Travel Credit, subject to the full Travel Credit Terms and Conditions at https://www.americanexpress.com/content/dam/amex/au/benefits/Platinum/TravelCreditTerms.pdf

- The Travel Credit can be redeemed through American Express Travel Online on a single eligible travel booking by selecting the Travel Credit when you checkout. To redeem the Travel Credit, the full value of the Travel Credit (or more) must be charged to the eligible Primary Card. Eligible travel includes flights, hotels and car hire when you prepay in advance. The Travel Credit can be used for 365 days from the benefit anniversary date and cannot be used past the expiration date. To check the expiration date of your Travel Credit if you have not already redeemed it, please visit americanexpress.com.au/travel; log in and click ‘Travel Credit’. If your booking is cancelled, and your Travel Credit has already been used and associated statement credit applied to your account, you will forfeit your annual Travel Credit benefit and American Express may reverse the statement credits issued. You need to be able to spend on the Card to access the Travel Credit benefit and it should be credited to your Card Account within 3 business days but may take up to 30 days. Your account must be in good standing and you must have paid the annual fee and minimum payment by the due date. If you cancel your Card, change your rewards program or Card type, you will no longer be eligible for the Travel Credit.

- Global Dining Credit.

- Maximum amount back is $200 on spend at participating local restaurants (Local Dining Credit) and AUD$200 on spend at participating abroad restaurants (Abroad Dining Credit) per redemption period: Each redemption period resets on 1 January until the offer end date of 31 December 2026.

- Primary Card Member Only: The Benefit is only available to Primary American Express Australia Platinum Card Members using their Platinum Personal Charge Card. Transactions made with an Additional Card is not eligible for this Benefit.

- Save this Benefit First: A one-time enrolment is required. You must first save the Benefit to your Platinum Card before making your payment to qualify for the Benefit. Benefit limited to the Card to which the offer is saved and only spend on this Card counts towards the Benefit. If you use another card to make a payment at any time, you will not be eligible for the Benefit on that card.

- If you switch to a new Card product that is not eligible for this Benefit, enrolment will be removed from your Card Account. If a Card you hold is ineligible, you will not be able to see the Benefit, nor will you be able to save the Benefit to the Card. If you are no longer eligible for this Benefit due to a change in Account status, including but not limited to fraudulent flags, suspension or cancellation, it will be removed from your Account.

- Eligible Transactions: Benefit only available for dine-in services made in-person at a participating restaurant, full list can be found here. Participating restaurant list subject to change without notice, please check before you dine as you won’t be eligible to receive a credit if the restaurant isn’t on the list at the time of your transaction.

- Excluded Transactions: Benefit excludes purchases of gift cards and vouchers, transactions made towards deposits charged upfront by the venue, booking, cancellation, and no-show charges, takeaway or dine-at-home services. If you spend in a currency other than Australian Dollars a Currency Conversion Fee of 3% applies and this fee does not count towards the Benefit. For more information regarding charges made in foreign currencies refer to your Card Member Agreement.

- Direct Payments Only: If you pay using payment processors such as QR payment or restaurant in-app purchases, you may not be eligible for the Benefit. Please request to pay at the restaurant’s designated checkout register.

- Award of Credits: Credit(s) should appear on your billing statement within 30 days from the date of payment but may take longer. Credit(s) are not redeemable for cash or any other payment form. Credit may be reversed if your qualifying purchase is refunded or cancelled.

- Expiry or Withdrawal of Benefit: The Benefit will expire on 31 December 2026. American Express can withdraw the Benefit at any time by giving you 60 days’ notice.

- Your use of participating restaurants: Your purchase of goods and/or services from the participating brands is governed by their respective terms and conditions (including privacy policies). American Express is not responsible in any way for the goods and/or services of the participating brands. Inquiries or complaints related to the participating brands’ goods and/or services should be directed to their customer service.

- Our General Offer Terms: Our General Offer Terms also apply to the Benefit and contain important additional terms.

- Additional Card Members must be 16 years of age or over. The Primary Card Member will be liable to pay for all transactions made by Additional Card Members. Earning of points is subject to the terms and conditions of the Rewards Program the Primary Card Member is actively enrolled. All points earned on Additional Card Member spend will go to the Primary Card Members Account. The Primary Card Member cannot add an Additional Card under their own name or email address and cannot add an Additional card under the name or email address of a previously approved Additional Card application on the Account.

- IMPORTANT INFORMATION: If the unexpected happens on your travels and a medical emergency arises, your first port of call is Chubb Assistance. In the event of an incident and to ensure you get appropriate, and fast, treatment from a doctor who speaks your language, you must call Chubb Assistance on +61 2 9335 3492 or the number on the back of your Card before seeking medical treatment, or you may be responsible for your medical expense costs. The insurance on American Express Cards is subject to terms, conditions and exclusions (such as maximum age limits, pre-existing medical conditions and cover limits). You must use your American Express Platinum Card to pay for your trip in order to be covered under the travel insurance and pay for eligible items for those items to be covered under the retail insurance benefits. It is important you read the American Express Platinum Card Insurance Terms and Conditionsand consider whether the insurance is right for you. We do not provide advice about the insurance or whether it is appropriate for your objectives, financial situation or needs. This insurance is underwritten by Chubb Insurance Australia Limited (ABN 23 001 642 020, AFSL No. 239687) under a group policy of insurance held by American Express Australia Limited (ABN 92 108 952 085, AFSL No. 291313). Access to this insurance is provided solely by reason of the statutory operation of section 48 of the Insurance Contracts Act 1984 (Cth). Card Members are not a party to the group policy, do not have an agreement with Chubb and cannot vary or cancel the cover. American Express is not the insurer, does not guarantee or hold the rights under the group policy on trust for Card Members and does not act on behalf of Chubb or as its agent. American Express is not an Authorised Representative (under the Corporations Act 2001 (Cth)) of Chubb.

- The Australian Premium Subscription benefit offer (‘Benefit’) is available to eligible American Express Australia Card Members (‘Card Members’). Once you have requested to enrol in The Australian Premium Subscription, American Express Australia Limited (‘American Express’) will determine your eligibility to enrol in the Benefit via the enrolment process. If eligible then American Express will share your enrolment information with Nationwide News Pty Ltd (‘News Corp’). News Corp may use this enrolment information in accordance with its privacy policy available here. The Benefit will provide eligible Card Members with; (a) a 12 month digital access to The Australian which provides premium content at theaustralian.com.au and via The Australian app; (b) eligibility to activate a digital subscription to the Wall Street Journal which will run concurrently with the subscription in (a) above; (c) a bespoke The Australian Premium e-newsletter sent every week and exclusive to subscribers of The Australian Premium subscription; and (d) access to The Australian annual event. Eligible Card Members must activate the Benefit described in (a) above in order to be provided with the opportunity to activate or enjoy the other parts of the Benefit. Card Members are not required to pay for the Benefit. Subscriptions provided under the Benefit will be automatically renewed every 12 months provided American Express and News Corp continue their arrangements in relation to this Benefit. Under the Benefit, you are limited to one digital subscription per eligible Card Member; not to be used in conjunction with any other offer; subscription is for digital content only; physical newspapers are not included. In addition to these terms and conditions, your use of the Benefit is subject to News Corp’s full digital subscription terms and conditions available here. For avoidance of doubt, terms and conditions contained here will take precedent in the event of inconsistency. Eligible Card Members will be required to agree to News Corp’s terms and conditions and privacy policy to activate the Benefit. News Corp may cancel any digital subscription provided under the Benefit at any time if the Card Member subscriber is in breach of these terms and conditions or the News Corp terms and conditions for any part of the Benefit, if notified by American Express that a Card Member is no longer eligible for this subscription or if American Express and News Corp cease to have an agreement relating to the continued provision of the Benefit. The value of the Benefit is not redeemable for cash or any other payment form. American Express may end this Benefit at any time.

- Invitations will be sent by email only. A valid email address and opt-in to Platinum Marketing communications is required. Event availability is strictly limited.

- The following are not Eligible Cards: Business Cards that are affiliated with a wholesale partner, American Express Business Travel Accounts, Government Cards, Corporate Purchasing Cards, Corporate Meeting Cards, Corporate Cards. To view Amex Offers, simply log into your Online Account or the American Express Mobile App. The account must being in good standing to be eligible for offers.

- International Airline Program

- American Express reserves the rights to change these conditions from time to time with 21 days prior notice and/or to discontinue the whole programme. To earn or redeem Membership Rewards points, Cards must be registered to the American Express Membership Rewards program, and be active and current in their payments. When paying with a combination of your American Express Card and Membership Rewards points, only the value applied to the Card is eligible to earn Membership Rewards points. Membership Rewards Terms and Conditions apply when booking on the American Express Travel website. Please visit the Membership Rewards website to view the full Terms and conditions (membershiprewards.com.au/termsandconditions).

- Airlines reserve the right to change, cancel or restrict flight operations without notice. IAP upgrades or specially negotiated fares may be limited by airlines to certain flights and/or dates (“blackouts”). IAP is subject to the terms and conditions of each participating carrier. American Express does not guarantee that seats or tickets will be available. Cabins of service and discounts vary by airline and route.

- To qualify for the IAP upgrades or specially negotiated fares: a) Your journey must start and end at the same port as designated by the participating airline and be completed within the period during which your selected carrier participates in the programme. You will be advised of any applicable dates at the time of booking. b) IAP tickets must be purchased through the American Express Travel Service and must be charged to a valid Australian American Express Platinum Card which is in good standing. c) The Platinum Cardmember who purchases the ticket(s) must be one of the travellers. d) IAP tickets are non-transferable and nonendorsable.

- Any travel on non-participating airlines must be ticketed and paid for separately and is not part of the IAP. Certain code share or flights on the worldwide partners of the participating airlines may not apply.

- Certain IAP airlines or non-participating airlines impose restrictions such as ticketing time limit on advance booking to indicate a timeline for ticketing upon making your reservations. For each individual airline Terms & Conditions, please check with the Platinum Travel Service for details.

- IAP upgrade offers or specially negotiated fares may not be combined with any other promotion, discount, negotiated or corporate rate.

- American Express acts only as an agent for travel service providers and does not own or operate any airline or means of transportation. American Express is not liable for service deficiencies on the part of airlines or other service providers, including but not limited to: accidents and injuries; delays; changes in routes or itineraries; loss, theft or damages to possessions. American Express strongly advises travellers to insure themselves against travel risks. Travellers are responsible for ensuring that they have valid documentation and for complying with the health, customs, currency and other laws of any country they enter or attempt to enter.

- IAP is available to Platinum Cardmembers from a variety of participating airlines each with specifically designated ports of departure and arrival. Please refer to the Platinum Travel Service for details of participating airlines, applicable routing and timetables and fares in force at any particular time. Other International Airline Program Terms & Conditions may apply.

- Savings are based on full-priced retail year-round airfares from Australia to select destinations with participating airlines in selected booking classes in First, Business and Premium Economy. Savings are calculated on the base fare and do not include applicable charges such as taxes, service fees, date change fees and cancellation fees. A maximum of 8 tickets can be purchased per Card Member per transaction. Prices are subject to availability and subject to change. All airfares must be purchased through the Platinum Travel Service and paid for on the Platinum Card. Airfares at sale prices may be released in the market at any time and reduce the featured savings. Fare rules including Advance Purchase, Min/Max Stay, any Penalties/Refunds, Stopovers/Transfers, Discounts (child/infant), and Taxes/Surcharges, are dependent on the airline’s Terms and Conditions and can vary. Airline Partners and offers vary and are subject to change. Contact Platinum Travel Service for full details on the International Airline Program.

- Unless we tell you otherwise, your American Express Charge card comes with flexible spending power, also known as no-pre-set spending limit. This means that the amount you can spend is dynamic and can adapt based on your transaction patterns, your business’ credit rating, and other factors. The way you use your Card can help your spending power grow, particularly in the first few months. To help maximise your spending power, make regular transactions and don’t miss any payments.

Fine Hotels and Resorts FHR program benefits are available for new bookings made through American Express Travel with participating properties and are valid only for eligible Platinum Charge Card Members and Centurion Members. Platinum Credit Card Members who are not also Australian Platinum Charge Card Members or Centurion Members are not eligible for FHR program benefits. Bookings must be made using an eligible Card and must be paid using that Card or another American Express Card in the eligible Card Member’s name, and that Card Member must be travelling on the itinerary booked. Noon check-in and room upgrade are subject to availability and are provided at check-in; certain room categories are not eligible for upgrade. The US$100 credit will be applied to eligible charges up to the amount of the credit. To receive the US$100 credit, the eligible spend must be charged to your hotel room. The US$100 credit will be applied at checkout. Advance reservations are recommended for certain US$100 credits. The type and value of the daily breakfast for two varies by property; breakfast will be valued at a minimum of US$60 per room per day. To receive the breakfast credit, the breakfast bill must be charged to your hotel room. The breakfast credit will be applied at checkout. If the cost of Wi-Fi is included in a mandatory property fee, a daily credit of that amount will be applied at checkout. Benefits are applied per room, per stay with a three room limit per stay. Back-to-back stays booked by a single Card Member, Card Members staying in the same room or Card Members travelling in the same party within a 24-hour period at the same property are considered one stay and are ineligible for additional FHR benefits Prohibited Action. American Express and the property reserve the right to modify or revoke FHR benefits at any time without notice if we or they determine in our or their sole discretion that you may have engaged in a Prohibited Action or have engaged in abuse, misuse, or gaming in connection with your FHR benefits. Benefit restrictions vary by property. Benefits cannot be redeemed for cash and are not combinable with other offers unless indicated. Benefits must be used during the stay booked. Any credits applicable are applied at checkout in USD or the local currency equivalent. Benefits, participating properties, and availability and amenities at those properties are subject to change. To be eligible for FHR program benefits, your eligible Card Account must not be cancelled. For additional information, please call the number on the back of your Card.

1 thought on “American Express Platinum Card”

I am already an Accor Plus member. My membership expires in October. When I join this programme will it start for a full 12 months at that time?