Founded in 2011, Wise (formerly TranferWise) is a currency exchange service that may suit those who frequently use money transfer services. The Wise account is a universal way for you to manage money internationally. As such, Wise has become viable for people who live and work in Australia, as well as Australian ex-pats who are managing their finances across multiple currencies and countries.

What is the Wise Multi-Currency Account?

The Wise Multi-Currency Account (formerly Wise Borderless Account) is for anyone who works or roams around the world. This account lets you store up to 50 types of foreign currency between five international bank accounts, including EURO, USD, GBP, AUD, CAD, NZD, SGD and JPY.

The Wise debit card functions just like a debit card you’d use from an Australian bank and is welcome anywhere Mastercard is accepted. You can use the Wise debit card to withdraw money and change it to the local currency, provided you are in a country (like Australia) that qualifies.

| Product name | Wise Multi-Currency Account |

| Card network | Mastercard |

| Free transactions per month | Unlimited |

| Savings interest rate | Wise does not offer a savings account |

| Mobile wallets | Apple Pay and Google Pay |

| Account funding options | You’ll need to have a transaction account with another financial institution to fund your Wise account |

Is the Wise Multi-Currency Account safe

Wise has served millions of customers a year for over a decade.

Fully registered and accredited, Wise protects your money by following strict rules set by regulatory agencies, and using the same encryption and data storage as the big banks.

Two-factor authentication protects your account on the Wise mobile app and an in-house digital security team works around the clock to monitor for suspicious activity.

Wise Multi-Currency Account features

The Wise Multi-Currency Account boasts an array of international features targeted toward the frequent traveller, making it easier to handle multiple currencies.

We’ve highlighted some of the Wise Multi-Currency Account features to help you decide whether this product suits your needs:

No account keeping fees unless you spend over €15,000 (about $23,800 AUD), in which case you will be charged 0.4% annually.

Hold more than 50 different currencies in your account at once and enjoy the ability to convert money in seconds. Wise supports all major currencies, plus many small ones, so there’s a good chance you’ll have the currency you need wherever your travels take you.

Shop like a local by transferring money to over 70 countries and using your card in 175 countries using the real exchange rate.

Connect up to five bank accounts across different countries and use Wise to transfer money between them.

No sneaky foreign transaction fees mean you can shop overseas and online without worrying about transaction fees.

A universal card allows you to spend as a local. If you’ve got the local currency, Wise will automatically use it. If not, they will convert it at a cheap rate.

Low conversion fees allow you to save up to seven times when you exchange money internationally. Wise always uses the cheapest conversion option.

Multiple language support means you can get customer support directly from Wise in a range of languages.

Pros

- No account keeping fees

- Store 50 foreign currencies

- No foreign transaction fees

- Internet shopping friendly

Cons

- Complex fee structure

- Not so competitive on regular cash withdrawals

- No physical branches

How to apply

It doesn’t take long to apply for a Wise Multi-Currency Account online, but note that it usually takes around two days for Wise to verify your identity.

Seeing as Wise is not a banking solution, you will need to hold a local bank account at another financial institution to fund your account.

To open a Wise Multi-Currency Account, simply visit the Wise website and click ‘Open an account’.

Then, you’ll need to fill out the required information including email address, phone number, country of residency and photo ID.

Eligibility

Signing up for a Wise Multi-Currency Account is quite simple, but there are some eligibility criteria to meet.

| Minimum age to apply | 18 years |

| Residency requirement | Wise accepts applications from people residing in most countries (including Australia, New Zealand, Singapore, the UK and US). |

| ID requirements | Photo ID |

Fees and charges

While there is no account keeping fee, nor any minimum balance to maintain a Wise Multi-Currency account, the fee structure is less competitive than that of some other transaction accounts.

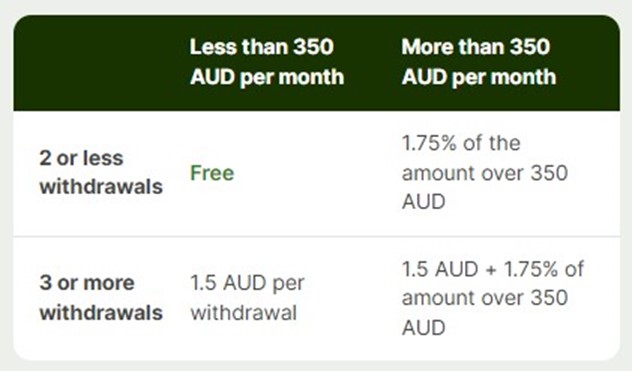

There are some complexities when it comes to ATM withdrawals – with cardholders incurring fees when withdrawing over a certain amount (varies between currencies).

For example, you can make two free withdrawals of up to $350 AUD each month. After that, Wise charges $1.50 per withdrawal, plus a 1.75% fee on any amount you withdraw above $350.

The table below provides an overview of the fees and charges cardholders can expect with Wise Multi-Currency account.

| Account keeping fee | $0 (you will be charged 0.4% annually if you hold more than €15,000) |

| ATM withdrawal fee (own network) | $0 (two withdrawals up to $350 per month. Withdrawals over $350 per month cost 1.75%) |

| ATM withdrawal fee (overseas) | $0 (two withdrawals up to $350 per month. Withdrawals over $350 per month cost 1.75%) |

| Foreign transaction fee | 0% |

| Currency conversion fee | Variable fee depending on the currency you’re transferring to (generally between 0.24% to 3.69%). |

| Physical debit card fee | $10 (one-off payment) |

| Replacement card fee | $6 |

ATM fees explained

While there are no fees associated with the digital card, you’ll need to pay $10 for a physical Wise card if you wish to withdraw cash.

Avoiding ATM fees with the Wise Multi-Currency Account is more complex than with some other travel cards and can require some forward planning.

For example, if you only needed to withdraw $100 this month, but know you’ll need more than $350 next month, it may pay to be strategic and withdraw the maximum $350 this month to avoid incurring fees.

The reality is that we generally need cash less often these days, however, if you’re someone who withdraws cash regularly the Wise Multi-Currency may not make sense.

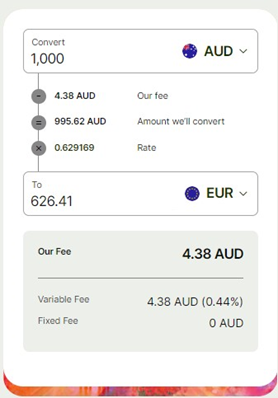

Conversion fees explained

Currency conversion fees depend on the currencies you are using and other factors. Wise offers a free conversion calculator to estimate how much money will arrive in your account and what fees you will pay.

The company does, however, promise low-conversion fees. These real exchange rates are the same ones you would find on platforms like Google or Reuters – Wise doesn’t charge commission and charges a flat fee for each currency exchange.

This helps users save money since banks often charge higher exchange rates that they set themselves. Wise also lets you set an alert so that you know when the exchange rate improves.

Could the Wise Multi-Currency account be right for you?

With an array of international spending features, the Wise Multi-Currency Account could be a good fit for people who regularly bank with multiple currencies.

Whether you’re a frequent traveler, on a working holiday or living life as an expat, the Wise Multi-Currency Account can help you hold over 50 currencies in your account, as well as transfer to more than 70 countries.

However, these perks do come at the cost of some fees that we don’t generally see with other travel debit cards. For example, you’ll need to pay a card delivery fee of $10 if you plan to use your account to spend.

It’s worth considering whether you would get use out of the Wise Multi-Currency Account’s features, if not, perhaps a low-fee digital bank account could be a better option.

FAQ: Wise Multi-Currency Account

What is a Wise multi-currency account?

The Wise Multi-Currency Account boasts an array of international features targeted toward the frequent traveller, making it easier to handle multiple currencies.

Is Wise multi-currency account free?

While there is no account keeping fee, nor any minimum balance to maintain a Wise Multi-Currency account, there are some fees depending on the value of your transactions.

What is the minimum balance for Wise multi-currency account?

The Wise Multi-Currency Account has no ongoing charges or minimum balance.

While you’re here: Subscribe to our newsletter for the latest tips, deals and news. It only takes a few seconds and we respect your privacy: