As Australia’s first homegrown neobank, ubank offers a range of products of choice for savvy spenders. With products aimed towards the digital generation, ubank (previously known as 86 400) holds appeal for a typically younger demographic.

While ubank has no physical branches, it operates entirely from a mobile app packed with helpful tools and insights that assist cardholders in managing their spending.

Ubank Spend account overview

The ubank Spend account functions as a transaction account linked to a Visa debit card. No monthly account fees, no overseas ATM withdrawal fees and no international transaction fees position the ubank Spend account as a compelling option for travellers, as well as everyday transactional use in Australia.

Here’s an overview of key ubank Spend account features to know about:

| Product name | ubank Spend account |

| Issued by | NAB |

| Card network | Visa |

| Free transactions per month | Unlimited |

| Savings interest rate | From 1 April 2023: 4.6% p.a. (0.10% base rate plus a 4.5% bonus rate) earned to a ubank Save account. This rate is variable and subject to change. To receive the bonus interest, you must deposit a total of at least $200 AUD per month into any of your ubank accounts (not including internal transfers). Bonus interest applies on balances of up to $250,000 per account. |

| Mobile wallets | Apple Pay, Google Pay, Samsung Pay, Fitbit Pay and Garmin Pay |

| Account funding options | PayID, BPAY, Osko |

The ubank Spend account comes with, and operates alongside, a linked ‘Save’ account, unlocking the ability to earn interest.

Is the ubank Visa Debit card safe?

While ubank is a neobank, it’s reassuring to know that all branded banking and financial ubank products – including the ubank Spend account – operate under NAB’s banking licence. This means deposits up to $250,000 per person are protected by the Financial Claims Scheme. Ubank also safeguards online banking security and privacy with advanced encryption technology.

Digging into the ubank Spend account benefits

The ubank Spend account can make it easier to travel and shop online without fees, as well as manage everyday spending with an array of saver tools.

Listed below are some of the ubank Spend account’s key benefits:

Sign on bonus: Receive a $20 sign up bonus when you join using the referral code ‘BONUS20’ and make three card purchases within the first 30 days. This means you can kickstart your new account balance.

Bank overseas without fees. Ubank customers won’t pay international transaction fees when shopping in person or online overseas. There are no ATM fees, however, it is still possible that some smaller bank-owned ATMs may charge a fee.

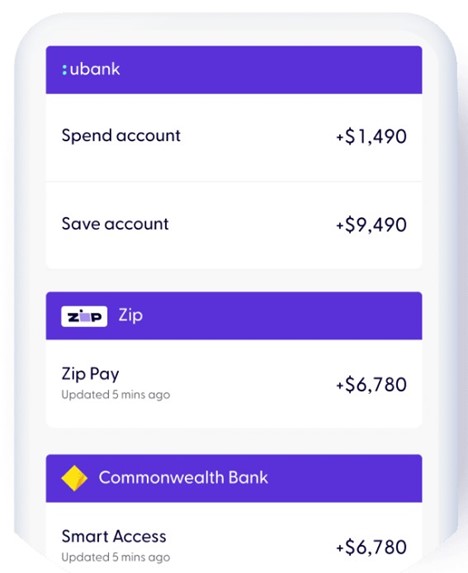

Multi-bank activity tracking allows you to connect and view your accounts with other banks. Ubank account holders can connect accounts – including super and investments – from over 140 other financial institutions.

A ‘Smart Search’ feature means that with one search, account holders can get the big picture of their money by finding transactions across any ubank account, as well as connected accounts with other banks.

Spending footprint helps you retrace your spending by tracking it for you. Ubank has created common spending categories and sorts your transactions for you, so you can see exactly how much you’re spending on that lunch break bakery run through a detailed transaction history.

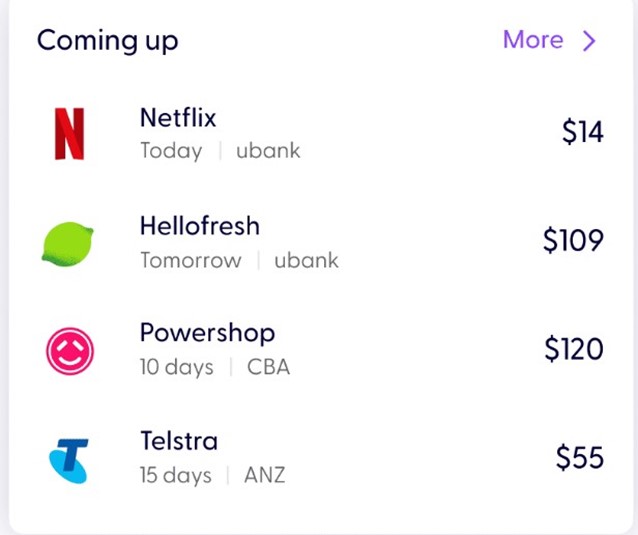

Automatic bill predictions take the guesswork out of spending. Ubank identifies regular payments, bills and subscriptions from over 200 companies, so you know what’s around the corner and don’t get caught out. I have personally found this helpful in identifying which subscriptions I no longer want or need.

Get a linked Save account when you join ubank. As well as your Spend account, you’ll get a Save account that comes with no fees and competitive interest rates.

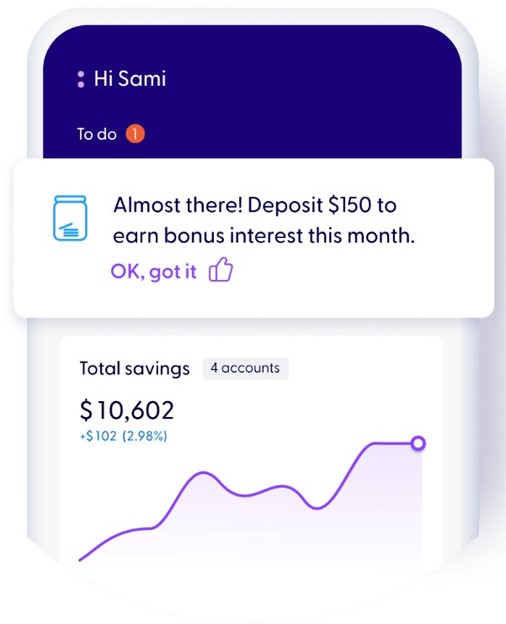

Earn interest to a Save account by transferring at least $200 per month into either your Spend or Save account (not including internal transfers). At the time of writing, it’s possible to earn up to 4.6% p.a. (from 1 April 2023).

Bonus interest reminders ensure you earn your bonus interest every month by prompting you to deposit the minimum amount required. For example, if you have already deposited $50 that month, the ubank Daily Money App will prompt you to deposit a further $150 to receive that bonus interest.

Free replacement card in Australia (minimal cost of $7 for Express Post) and the ability to put an immediate hold on your debit card via the banking app means ubank should have your back in the event that your card is lost or stolen.

Withdraw without losing interest. Unlike many other interest-earning savings accounts, the ubank Save account lets you make withdrawals without losing the month’s bonus interest. This means you can take out a little (or a lot) without having to weigh up forfeiting your interest.

Pros

- Competitive interest rates

- No foreign transaction fees

- No account keeping fees

- Sign on bonus

- Smart features to assist managing your money

Cons

- Digital, mobile-only product

- No physical branches

- No rewards

How to apply for the ubank Spend account

Applications for the ubank Spend account need to be submitted online, as ubank is a digital-only bank without any physical branches. Of course, no branches typically means fewer costs and lower fees for members.

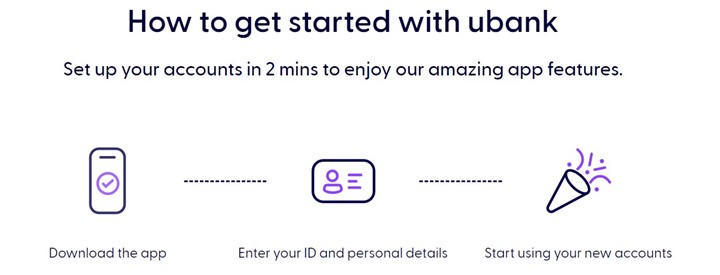

Joining is free and takes minutes, with no credit checks or income assessments required. To open an account, download the ubank Daily Money App on iOS or Android.

Once your application has been accepted, your new ubank Visa debit card should arrive in the mail to your residential address within three to five business days.

It is worthwhile noting that by opening an ubank Spend account you will also get a Save account as well.

Eligibility

While joining is quick and easy, there are a few requirements you’ll need to meet to sign up for a ubank Spend account.

| Minimum age to apply | 16 years |

| Residency requirement | Must have a valid Australian residential address and be an Australian citizen or permanent resident |

| ID requirements | Valid Australian driver’s license or passport, tax file number and an Australian mobile number |

Fees and charges

Ubank’s competitive fee structure means Spend account holders won’t be charged account-keeping fees.

While there is no minimum balance to maintain the account, there is a maximum balance of $5 million across all Spend and Save accounts.

The table below provides an overview of the fees and charges that ubank Spend account holders can expect when using their debit card.

| Account keeping fee | $0 |

| ATM withdrawal fee (in Australia) | $0 (some ATM operators may charge a fee) |

| ATM withdrawal fee (overseas) | $0 (some ATM operators may charge a fee) |

| Foreign transaction fee | 0% |

It is important to note that while account holders won’t incur a fee at most major bank-owned ATMs in Australia and overseas, some external ATM operators may charge their own fees.

The ATM operator must, however, notify you of any fees. Pay attention to any fee messages on the ATM when withdrawing cash, particularly overseas.

Could a ubank Spend account be right for you?

A ubank Spend account may offer value, particularly for Australians who want access to a digital mobile-only product, offering the potential to help them travel with ease. That said, this product may not be suited to everyone. Those who value ongoing rewards and the benefits of a physical branch may not find this debit card particularly useful.

With no foreign transaction fees, the ubank Spend account is positioned as an appealing option for frequent overseas travellers and online shoppers. Plus, no account keeping fees or minimum balance allows the account holder to use it as a standard transaction account between trips.

Travel aside, used alongside an accompanying ubank Save account, cardholders can benefit from competitive interest rates, withdrawing as many times as they like without losing bonus interest. Used for everyday spends, modern features including automatic bill detection, Smart Search and multi-bank activity tracking could also make the ubank Spend account a good fit for the modern banker.

FAQ: uBank Spend account

What is the minimum balance for ubank spend account?

There is no minimum balance but there is a maximum $5m balance limit across your accounts.

Does the ubank spend account have an account-keeping fee?

There is no monthly account-keeping fee.

How much can I withdraw on a daily basis from my ubank spend account?

There is a limit of $2k per day whether in-person or online, domestically and overseas.

While you’re here: Subscribe to our newsletter for the latest tips, deals and news. It only takes a few seconds and we respect your privacy: