Introducing Up banking. Founded in 2018, Up is an Australian mobile-only digital bank that runs entirely from an app on your smartphone.

Coined as the bank for young Australians, Up aims to win its demographic over with features such as a competitive fee structure, leading app tools and not lending to any fossil fuel projects.

What is the Up Everyday Account?

The Everyday Account boasts no account-keeping fees, a quick setup, and modern app features. With no foreign transaction fees either, could an Up debit card be your new travel partner?

Up’s Everyday Account has the ability to be linked to a Saver Account. Other key features that make the Up Everyday Account stand out include a user-friendly interface that allows users to review spender history, payment splitting, the ability to detect upcoming charges, as well as pay friends by name.

The table below provides an overview of key Up Everyday Account features to know about:

| Product name | Up Everyday Account |

| Issued by | Bendigo |

| Card network | Mastercard |

| Free transactions per month | Unlimited |

| Online transactions | Unlimited |

| Savings interest rate | Not applicable for Everyday Account, but 2.10% p.a (for Up Savers accounts) Capped interest is paid on the combined balance of Savers up to $1M |

| Mobile wallets | Apple Pay, Google Pay or another digital wallet of choice (Samsung Pay, Fitbit Pay and Garmin Pay) |

| Account funding options | Pay Anyone, BPAY |

Beyond the Up Everday Account, Up operates three additional types of accounts as follows:

- 2Up Joint Accounts (for couples)

- Up Saver Account

- 2Up Saver Account (for couples)

Up Everyday Account and Up Saver Account: what’s the difference?

Up’s two personal accounts are designed to operate alongside one another, providing the user with access to Up’s full range of features.

While Up Everyday Account transactions do not earn interest, they can be linked to a debit or Mastercard unlocking the benefits of mostly feeless travel.

Meanwhile, the Up Saver Account earns stepped interest, which is calculated daily and paid monthly. This is how users could make the most of Up’s saving tools, including its Roundups feature.

Funds can be transferred between Up Everyday and Up Saver accounts an unlimited number of times. There are no charges for this.

Being an entirely mobile digital bank, Up users get an Everyday transaction account with a debit MasterCard and the option to create multiple Savers accounts from within the app.

Is the Up Everday Account safe?

As a neobank, all Up branded banking and financial products in the Up app – including the Up Everyday Account – are issued by Bendigo and Adelaide Bank. Up is one of the highest-rated banking apps in Australia and uses advanced security technology such as smartphone biometrics and advanced cryptography. Up ensures that up to $250,000 per person in deposits is protected by the Financial Claims Scheme.

Up Everyday Account features

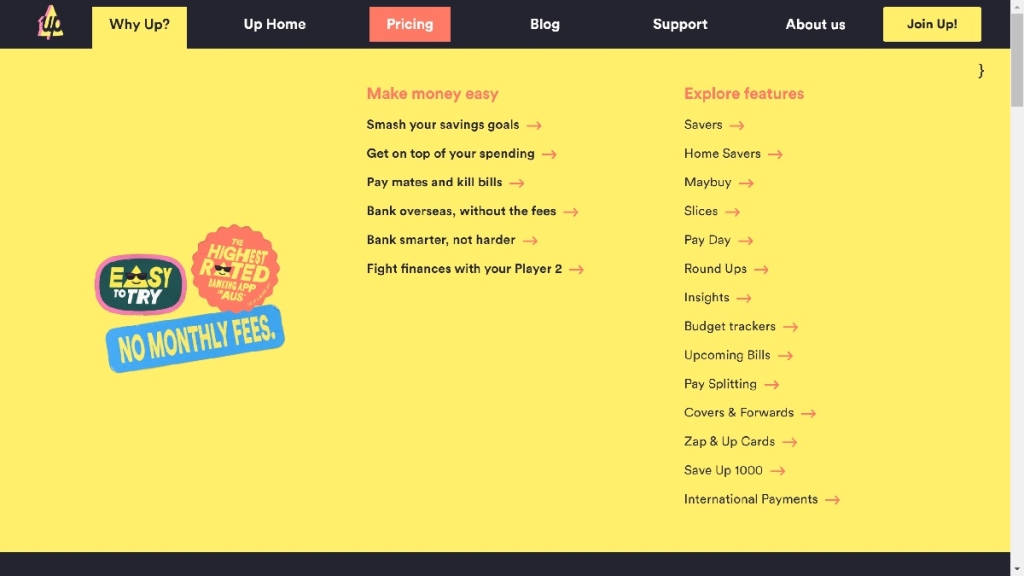

The Up Everyday Account boasts an array of features targeted towards a younger demographic, making it easier to travel, split payments and save.

I have personally found this product to be convenient when travelling, as well as for purchasing online goods from overseas retailers.

Listed below are some of the Up Everday Account’s best features:

- Bank overseas without the fees. Up Cardholders won’t pay international transaction fees whether they shop in person or online overseas. There’s also no added conversion or mark-up fees, nor any ATM fees. It may still be possible that account holders will incur a fee at smaller bank-owned ATMs, or other external fees outside of Up’s control.

- Other travel aids include in-app controls to lock quickly and easily lock a lost card. The app also displays purchases in AUD and foreign currency amounts together so account holders know exactly what they’re spending.

- No exchange rate markups when sending money overseas means ‘Upsiders’ know exchange fees upfront, as well as how much the recipient will see in their foreign currency.

- A ‘Round Ups’ feature can encourage cardholders to get into good savings habits by rounding up purchases to a chosen amount, putting extra cents into a desired Up savings account.

- Automatic bill detection means Up can predict regular charges and bills in order to assist in budgeting by reminding when direct debited payments are approaching.

- Multiple Savers may allow account holders to save better by creating a savings account for every money goal, complete with a custom motivational name and emoji.

- Categorised transactions provide real-time spending reports that can make it easier to manage everyday spend.

- Pay using an Upname. Geared towards a younger demographic, Up rolls out a unique handle known as an Upname. The feature allows Up users to send money with no swapping of baking details necessary. This makes it easier to remember and share a PayID, giving the option to simply pay a friend back or send a surprise money gift.

- Sliced purchases allow split payments in whichever way amongst account users. Whether it’s a shared streaming account, rent, tickets, or a weekly grocery shop, the cost can be split between 2 or 20 people. No manual bank account details need to be entered.

- Un-packaged Zap Digital Cards provide cardholders with a plastic-free option, however, there’s still the option to be sent an Up Plastic Card in the mail. I have personally found the physical card too good-looking to deny using it!

- Up’s ‘Hook up a mate’ promotion gives users the chance to win weekly prizes as well as a guaranteed $5 in the bank for inviting friends to join. This is effectively the only reward-based perk available for a product that is more focused on a competitive fee structure and convenience.

Pros

- Competitive fee structure

- No overseas purchase fees

- Unlimited transactions per month

- Covered by Financial Claims Scheme

Cons

- No branches for support

- Not suitable for those desiring a rewards structure

- Low interest on balances

How to apply for Up

Up is a digital-only ‘neobank’, which means there are no physical branches and applications must be submitted purely online. To open an account, download the Up Easy Money app on iOS or Android.

Applicants need to be over 16 years of age and provide an Australian home address and Driver’s Licence.

Once the application is complete and the user verification process has been finalised, all Up accounts are ready to use right away with a digital card. Users who opt for a physical card should receive it in the mail within 5 to 10 business days.

Up’s application form is mobile-friendly and simple to fill out – it should only take a few minutes.

Eligibility

Essentially anyone over the age of 16 who lives in Australia can open an Up Everyday Account as long as they have $1 and the Up Easy Money app.

| Minimum age to apply | 16 years |

| Residency requirement | An Australian resident with a valid Australian address |

| ID requirements | Driver’s License |

| $ to open an account | $1AUD |

Fees and charges

The competitive fee structure means Up Everyday Account holders won’t be charged unless the account is overdrawn.

There is no account-keeping fee, nor any minimum balance to maintain the account.

The table below provides an overview of the fees and charges cardholders can expect with an Up Everyday Account.

| Account keeping fee | $0 |

| ATM withdrawal fee (own network) | $0 |

| ATM withdrawal fee (overseas) | $0 at most major banks |

| Foreign transaction fee | 0% |

| Overdrawn interest rate | 11.23% p.a. |

Note that while account holders won’t incur a fee at most major bank-owned ATMs in Australia and overseas, some smaller ATM operators may charge external fees.

However, the ATM operator must notify you of any fees, so keep an eye out for a fee message on the ATM when withdrawing cash, particularly overseas.

Could an Up Everyday Account be right for you?

An Up Everyday Account may offer value, typically for young Australians who want a card (or no card) that can possibly help them travel with ease. That said, it’s not suited to everyone – particularly those who value rewards and the benefits of a physical branch.

With no foreign transaction fees, the Up Everyday Account is positioned as an appealing option for frequent overseas travellers or online shoppers. Plus, no account-keeping fees or minimum balance allows the account holder to use it as a standard transaction account between trips.

Travel aside, used alongside an Up Savings Account, urban features including Sliced purchases, Upnames and Digital cards could make an Up Everyday Account a good fit for the modern banker.