Ethical investing is a hot topic, but could it be a matter of going broke by getting ‘woke’?

Many people think of making money and creating a better world as mutually exclusive – nice guys finish last, right? Not necessarily. Cue ethical investing – the green bridge between money and doing good.

Getting ahead with passive income doesn’t have to cost the greater good. In fact, recent decades have seen a notable shift towards investors putting money in companies that align with their values and morals, otherwise known as ethical investing.

As with any financial decision, it pays to understand what you’re doing. We’ve set out to simplify the ethical investing trend: Here’s what to know.

Disclaimer: The information in this article is of a general nature and does not take into account your personal circumstances. You should consider whether the information suits your needs and seek guidance from a professional financial advisor.

What is ethical investing?

Also known as sustainable or responsible investing, ethical investing simply means considering ethical factors such as animal cruelty, climate change, and human rights abuses when investing your money.

While good returns are usually the sole focus of an investment strategy, ethical investing considers ethical values on the same level as returns when choosing which companies to invest in.

Recent years have seen many Australians direct their concerns toward society and the environment. This is reflected by data from the Responsible Investment Association Australasia (RIAA), which showed that four out of every five Australians feel that the prosperity of the environment is of utmost importance when it comes to making returns on their investments.

Why invest ethically?

Let’s answer this first: why invest at all? Investing can be a way to make passive income and reach your money goals faster. Whether those goals are to live comfortably, provide a nest egg for the family, achieve financial independence or retire early, done well, investing can be a way to gain financial security.

Investing ethically adds another – some would say equally important – layer to the mix. The reality is that you have power as an investor.

Consciously deciding to invest your hard-earned money in companies that align with your moral, religious and/or social values focus is a legitimate investment strategy and can be a way to preserve wealth while creating social change.

Who is ethical investing for?

Most of us exchange a large portion of our time for money. If you’re someone who cares how that money is being used after you invest it, then chances are ethical investing could be for you.

Similarly, ethical investing could also be a positive path for those who live by any sort of moral code – perhaps you recycle soft plastics, don’t use them at all, or consider how workers have been treated before purchasing goods.

When considering if ethical investing is for you, simply ask yourself: Do I care how my money is being used?

What are the different ethical investing approaches?

There are some common approaches to investing ethically. The strategies you employ may depend on your personal values or reasons for choosing to become an ethical investor.

Let’s take a look at the main approaches.

Negative screening

Taking a negative screening approach looks like actively excluding industries that you may not wish to support. Here is a list of industries that ethical investors commonly want to avoid:

| alcohol | illegal logging |

| animal cruelty | pornography |

| armaments | labour right violations |

| fossil fuels | nuclear power |

| gambling | genetic engineering |

| human right abuses | tobacco |

Actively deciding against investing in companies that support some or all of these industries is taking a negative screening approach to ethical investing.

Positive screening

Flip the ethical investing approach coin and you have positive screening, which essentially means conducting research to seek out companies that make a difference that aligns with your values.

For example, an ethical investor interested in green property may consider investing in a company like Tesla. Companies that make a difference may operate in the following sectors:

| education | energy efficiency | sustainable fashion |

| green property | sustainable companies | sustainable infrastructure |

| healthcare and medical products | sustainable land management | high scoring ESG companies |

| impact investments | sustainable transport | vocational training |

| renewable energy | sustainable water | gender lens investing |

ESG integration

As mentioned in the table above, Environmental, Social and Governance (ESG) integration involves looking at each of these factors when choosing an investment.

Integral to ethical investing, this straightforward approach uses this information to make informed decisions.

The RIAA cites the example of an investor who is going to invest in an oil company and uses the ESG approach to find the company that has the best environmental performance and employee treatment record.

Impact investing

Impact investors will actively seek out companies that are impact-focused, meaning that it is their mission to work on solving the world’s bigger problems, such as poverty.

This means the company will have made a tangible real-world difference. Impact investing can be a good way to find out which companies are putting their green money where their mouth is.

Know your options: Different types of ethical investments

Once you begin to understand yourself as an ethical investor (what you want to include/avoid in an investment) you can begin to consider what kinds of investments you want to make.

Different types of ethical investment options include superannuation, managed funds, direct investments (shares) and EFTs. Here’s an overview of each:

Super funds

There’s been a lot of talk about switching to sustainable superannuation funds in recent years. Often aimed at younger investors, a growing amount of super funds offer members ethical and sustainable investment options.

Responsible Investment (RI) super funds are where more Australians are deciding to invest their nest egg, but it can be difficult to know which funds actually operate ethically.

In 2021, the RIAA assessed a range of Australian super funds against its strict criteria and found a list of 13 funds that were identified to demonstrate a comprehensive approach to responsible investment.

Here’s the list of responsible funds to consider:

| Australian Ethical | Future Super |

| AustralianSuper | HESTA |

| CareSuper | Local Government Super |

| Cbus | NZ Super (New Zealand) |

| Christian Super | Unisuper |

| First State Super | VicSuper |

| Future Fund | Vision Super |

How ethical super funds invest your money

Ethical super funds should only invest your savings in ethically responsible companies with high ESG standards and practices.

These commonly include the sectors listed as part of the positive screening approach. Meanwhile, ethical super funds generally won’t invest in companies that support negative screening factors such as environmental destruction and social harm.

ETFs (Exchange Traded Funds)

An ETF is essentially a basket of investments such as stocks or bonds that allow you to diversify by investing in a variety of investments at once.

Some companies such as Vanguard and Australian Ethical offer ETFs, but some perform more ethically than others.

A good place to start is Stockspot, which now has a selection of sustainable portfolios that only include sustainable ETFs.

Managed funds

As it sounds, managed funds are typically run by an insurance company on behalf of an investor. Some managed funds that offer ethical investment options in Australia include:

- AMP

- Australian Ethical

- Mercer

- Pendal

- Pengana

- U Ethical

- Vanguard

Shares

Purchasing shares in companies that align with your values is another way to invest ethically. This may involve employing some (or all) of the aforementioned approaches to effectively identify which stocks you may prefer to invest in.

How to find ethical investments

Finding which companies and funds you want to support involves using ethical investing approaches to conduct research.

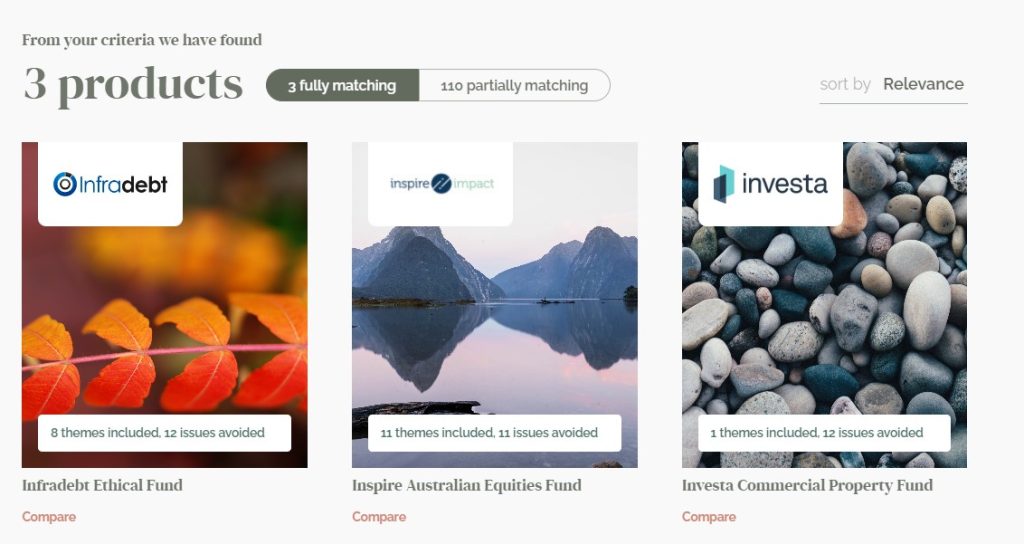

The RIAA’s Responsible Returns initiative has a helpful search function that allows potential investors to implement some of these strategies in their search for ethical and responsible super, banking and investment products.

For example, I used the search to find an investment in green property that avoids fossil fuels, human rights abuses and illegal logging.

I was met with 3 products that fully matched my search, with 110 partially matching results to consider as well. Chances are, you’ll have your homework set out for you.

The Responsible Returns website also features a useful directory that lists 70 providers located in Australia whose products have been certified in accordance the RIAA’s Responsible Investment Certification Program.

The program assesses whether a product or find’s investments align with its responsible investment claims.

Plus, you can filter the results by the different investment approaches to ensure the results, in turn, align with you.

When considering investing ethically, it may also be a good idea to seek the advice of a finance professional. The Ethical Advisers’ Co-op is a good place to find certified ethical financial advisers.

What should I consider in an ethical investment?

There are some key considerations to take into account when choosing an ethical investment that best suits you.

Your personal values will likely play a big role in your screening process. Understanding what issues you care about will help you refine which investment opportunities are going to add that ‘feel good’ element to your returns.

Being aware of fees is just as important as making sure your investment aligns with your values. Ongoing fees should always be a key consideration when comparing investment options.

Digging deep into a potential investment’s documents should also be a big part of your research. Knowing where your money is going usually isn’t as simple as reading a brochure.

Performance should not be sacrificed due to the ethical nature of an investment. At the end of the day, the intention behind investing is to make money, so you want to make sure you’re still getting those returns.

While past performance is not always an indicator of future returns, it’s always worth considering how the investment has performed compared to others in its playing field.

Advantages of ethical investing

Investors usually feel a sense of happiness and accomplishment when a holding company performs well, but many will say that investing ethically is more rewarding.

Emotional reward: On an individual scale, ethical investors may walk away with a good return, as well as the emotional satisfaction of benefiting financially from a company that shares their values (which some will argue is worth just as much).

Good returns: On that financial benefit, ethical investments can actually outperform traditional investments. A 2020 Morningstar study that analysed 745 sustainable funds against 4,150 traditional funds found that sustainable funds performed better.

When looking at large global companies, the study found the returns for sustainable funds to be 6.9% a year, compared to 6.3% for traditional funds.

Catalyst for change: Plus, advantages exist on a much broader level too. As the ethical investment trend continues to gain traction, we can also expect to see other businesses improve their ethical practices in order to attract investors.

Disadvantages of ethical investing

As with most financial approaches, there are a few downsides to bear in mind.

More effort: Ethical investing is an active strategy, which means the investor must conduct heavy research to dig deep into a company’s ethical practices.

Considerations are not purely limited to which company offers the best returns, with value systems and ESG performance playing a major role in investment decisions.

Higher fees: Consequently, ethical funds front a much higher fee structure. We would say this is the biggest pitfall of opting for an ESG fund.

Greenwashing: A lack of universal standards means that companies currently self-report their sustainable data.

This leads to greenwashing, meaning that a company may promote its environmental impacts without actually having any tangible benefit.

Conclusion: Does ethical investing work?

Ethical investing is very much a case of maximum effort for maximum reward. There is a lot to say about the emotional benefits that accompany the decision to invest in a company that aligns with your belief systems and actually delivers real-world change.

Investing ethically can also give investors the power to influence business operations; as more people choose an ethical investing approach, companies will likely have no choice but to review their ethical practices.

With carefully considered research using the different ethical investing approaches, the added emotional benefit of feeling good about your financial gain does not have to come at the cost of good returns.

What do you think about ethical investing?

While you’re here: Subscribe to our newsletter for the latest tips, deals and news. It only takes a few seconds and we respect your privacy: