Over the past few years, ‘buy now, pay later’ services, also known as BNPL, have continued to grow at a fast pace. This year, millions of Australians have entered into BNPL arrangements, seeking choice and convenience – with no interest fees to pay.

This post has been prepared in partnership with American Express. We may receive a commission if you apply for a product using a link in this post.

Since many of our readers use BNPL, we’re excited to cover American Express’ convenient and fully-integrated service, Plan It™ Instalments. If you already hold an eligible American Express Credit Card®, get started with American Express Plan It™ right now by clicking this link.

Plan It allows customers to pay off their Credit Card balance in equal monthly repayments. Whether you’re new to American Express or you already hold an eligible Card, Plan It™ could make sense for your circumstances.

Read on to discover everything you need to know about Plan It™ and how to use it. Plus, we’ll show you how it stacks up against the competition in the BNPL space.

What is American Express Plan It™?

American Express Plan It™ is a built-in feature that allows customers to pay off a portion of their Credit Card balance over a fixed monthly timeframe. There is 0% interest charged. However, Plan It users are instead levied a monthly fee to access the service.

Anyone with an eligible American Express Card can use Plan It™ to pay off a balance of at least $150, over 3, 6, 9 or 12 months. Interest is not charged on balances moved into an instalment plan. Instead, Plan It™ offers a fixed monthly fee which is factored into your monthly repayments.

Who can use Plan It™?

All American Express personal Credit Card Members (excluding David Jones) can use Plan It™. At this stage, there is no access for Business Cards and Corporate customers or for personal Charge Cards (this includes the Platinum Card).

If you don’t yet hold an American Express Credit Card, you can view current offers here.

3 step guide to using American Express Plan It™

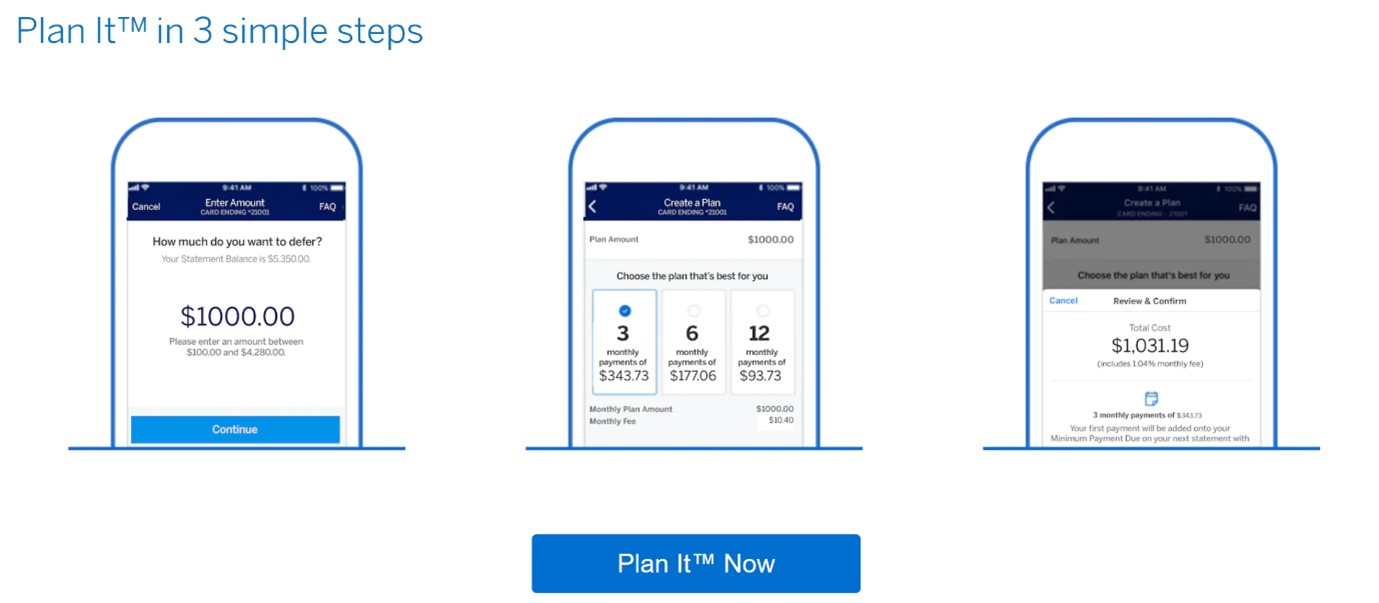

It’s very easy to get started with Plan It ™. Since it’s already built into American Express Credit Card products, there’s no application process needed for existing customers.

Simply spend on your American Express Card as usual. Once your monthly card statement arrives, you can choose to create a new Plan It™ instalment plan.

This process can be completed through your Online Account or through the American Express mobile App in three simple steps:

Step 1 – Choose how much of your balance you want to pay off through Plan It™

Step 2 – Select your plan duration (3,6, 9 or 12 months)

Step 3 – Review and submit your plan

How much does American Express Plan It™ cost?

While there is 0% interest charged, American Express Plan It™ users are levied a monthly fee that is added to their minimum monthly payment on their Credit Card statement. The monthly fee works out to be equivalent to the interest that would’ve been charged had users not used Plan It™, but instead rolled over their balances.

How much can you expect to pay? The monthly fee charged depends on the type of card you hold. It can range anywhere between 0.42% and 1.04% of the plan amount. A minimum amount of $150 applies to all plans.

Whenever you create a new payment plan, you’ll be shown the term and fee options that are available.

Using the Plan It™ Calculator

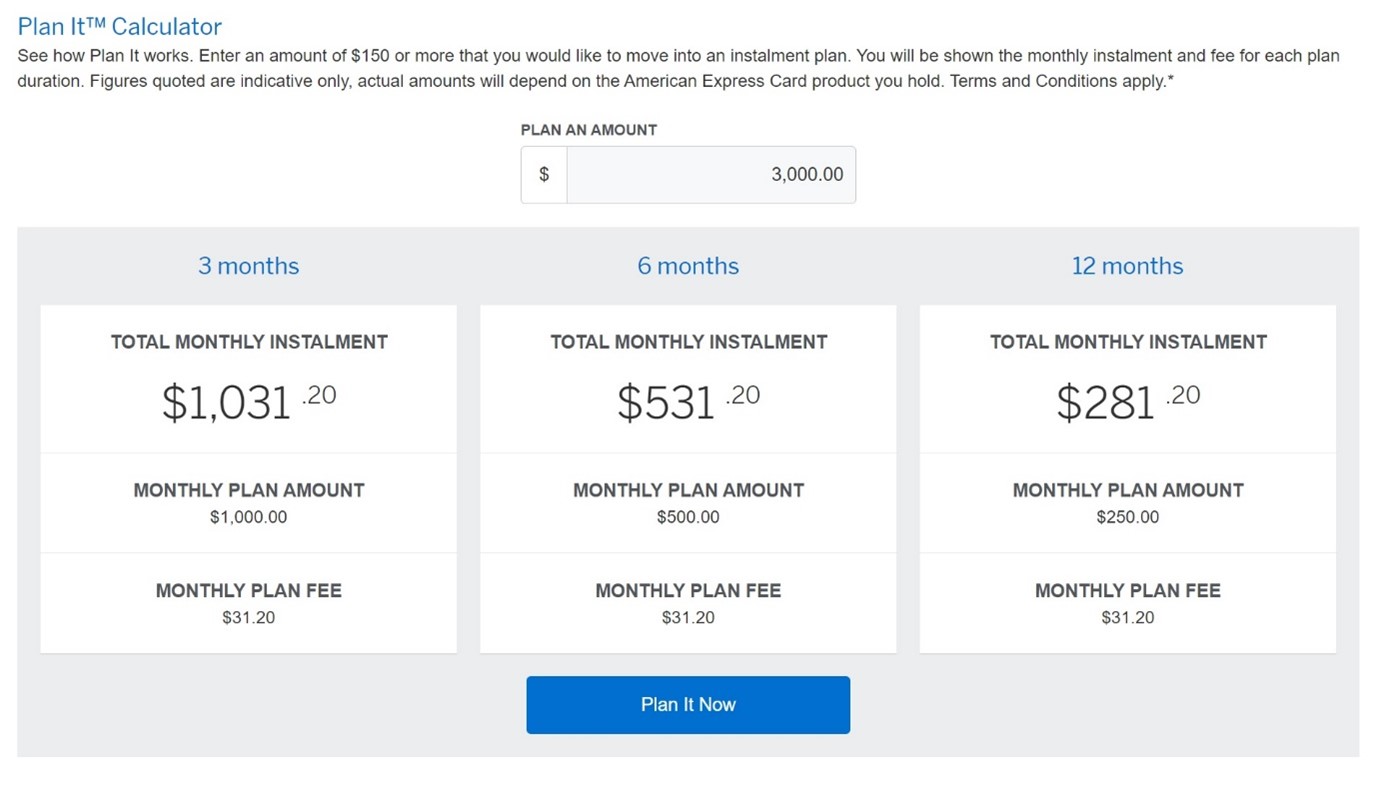

When considering any BNPL service, crunching fees and charges is key to determining whether a tool can work for you.

Before submitting your plan, head to the handy Plan It™ Calculator on the American Express website to find out exactly what you can expect to pay. This is based on your outstanding balance, the card you hold and your preferred repayment timeframe.

In the example below, I have elected to create a plan for $3,000 to pay off over time. I can choose to pay $1031.20 monthly over 3 months, $531.20 monthly over 6 months or $281.20 over 12 months. All figures include the monthly plan fee.

There is no stipulation that you must stick to the repayment timeframe, you are free to make earlier repayments or cancel the plan at any time. There are no cancellation fees, however, any monthly plan fees already billed will not be refunded.

Discover American Express Credit Cards

Thinking about picking up an American Express Card? From a $0 annual fee to premium offerings, there are plenty of products available. Discover current offers below:

^Plan It™ Terms and Conditions – $0 Monthly Fees for 3 Month Plans

- You can create an Instalment Plan as long as your account is in good standing. American Express may limit the amount that can be transferred to an Instalment Plan.

- Each Instalment Plan will begin from the date it is successfully created, as communicated to you in your Online Account.

- Payment of your first Monthly Instalment will be due in your next payment cycle.

- $0 Monthly Plan Fees are only available on 3 Month Plan terms created by 28 Feb 2022. Offer is not available on 6, 9 or 12 month plans, you will be charged Monthly Plan Fees for plans created with terms greater than 3 Months.

- You will be charged a Monthly Plan Fee for each Instalment Plan created.

- This fee will be charged each month your Instalment Plan is active and will be notified to you before you create the Instalment Plan.

View the full Plan It™ Instalment Terms and Conditions here

FAQ – American Express Plan It™

Who can use American Express Plan It?

Most American Express Cards are eligible for Plan It. To see if you can use Plan It, log in to your Online Account or the Amex App. If your Card is eligible, you will be able to start creating instalment plans.

How do I create a new payment plan via American Express Plan It?

It’s quick and easy to create a new instalment plan. You can do so through your Online Account or through the Amex mobile App. Simply choose how much of your balance you want to pay off through Plan It, select your plan, then review and submit your plan.

How long do I have to pay off my American Express Plan It Instalments?

With Plan It, you have the flexibility to spread payments over time. When you set up your instalment plan, you can opt to pay off your balance over 3, 6, 9 or 12 months. Conversely, some other BNPL providers require customers to make payment of an outstanding balance over 4 equal fortnightly payments.

Will I incur fees for using American Express Plan It?

Yes, a fixed monthly plan fee applies for each instalment plan you take out. The monthly plan fee will be charged each month that your plan is active. Before you create a new payment plan, you’ll be shown the fees that apply, so you can decide whether Plan It makes sense for your own personal circumstances.

Can I create multiple plans?

Yes, you can create multiple instalment plans per month. The number of plans you can have at any one time will depend on your Card and credit limit.

Can additional Card Members use American Express Plan It?

No, only primary Card Members and Authorised Account Managers with full access to your account can create instalment plans.

Can I cancel my plan?

Yes, it’s possible to cancel your instalment plan at any time with no cancellation fee. Once your plan has been cancelled, any remaining plan balance will go back on to your standard balance. Note that any monthly plan fees already billed will not be refunded.

This post has been prepared in partnership with American Express.

While you’re here: Subscribe to our newsletter for the latest tips, deals and news. It only takes a few seconds and we respect your privacy: