As an established bank with flexible banking options, ING offers an appealing choice for account holders with various needs. Introducing the ING Orange Everyday Account.

Bursting onto the scene 20 years ago, ING is known for offering one of Australia’s first high interest, fee-free online savings accounts. Since this time, ING has positioned itself as a long-trusted bank for locals, which to this day, aims to offer simplicity.

Editor’s Note: The ING Orange Everyday Account will no longer come with overseas ATM Operator Fee Rebates from 1 August 2023.

What is the ING Orange Everyday bank account?

The ING Orange Everyday account operates as a transaction account, with the ability to link to a Visa debit card.

Value-adds including cashback on utility bill payments can leave extra money in your pocket, positioning the ING Orange Everyday account as a compelling option for day-to-day use.

With the potential to meet monthly deposit and purchase requirements to minimise fees and charges, the ING Orange Everyday account may also offer functionality as a travel money option.

Here’s an overview of key ING Orange Everyday account features to know about:

| Product name | ING Orange Everyday |

| Issued by | ING Bank Australia |

| Card network | Visa |

| Free transactions per month | Unlimited |

| Savings interest rate | Up to 4.05% p.a. earned to an ING Savings Maximiser account. This rate is variable and subject to change. To receive the bonus interest, you must deposit a total of at least $1,000 AUD per month into any of your Orange Everyday account (not including internal transfers from ING Living Super, Personal Loans and Orange One accounts). You must also make at least five card purchases using your ING debit card (excluding ATM withdrawals, EFTPOS cash out only transactions. Balance enquiries and cash advances). Finally, the balance of your Savings Maximiser account must be higher than it was at the end of the previous month (interest earned in the current month does not count). |

| Mobile wallets | Apple Pay, Google Pay |

| Account funding options | BPAY |

The ING Orange Everyday account is designed to operates alongside a linked Savings Maximiser account. This account unlocks the ability to earn competitive interest.

Unpacking the ING Orange Everyday account features

Provided you meet monthly spend and deposit requirements, the ING Orange Everyday account can make it possible to avoid fees overseas. It unlocks the ability to pay your way with multiple payment options and to boost savings with competitive interest earn rates and helpful saving tools.

Listed below are some of the ING Orange Everyday account’s key benefits:

Utility bill cashback: When using the Orange Everyday account to pay gas, electricity, and water bills via BPAY or direct debit (BSB and account number), account holders can receive 1% cashback from eligible providers (T&Cs apply). There’s a need to meet the monthly deposit and spend requirements to enjoy up to a $100 cashback benefit per financial year.

No monthly fees mean that account holders won’t pay any fees to hold an ING Orange Everyday account, no matter how much you deposit or spend. That means there are no monthly account-keeping fees whether you use your card all day every day or not at all. T&Cs apply.

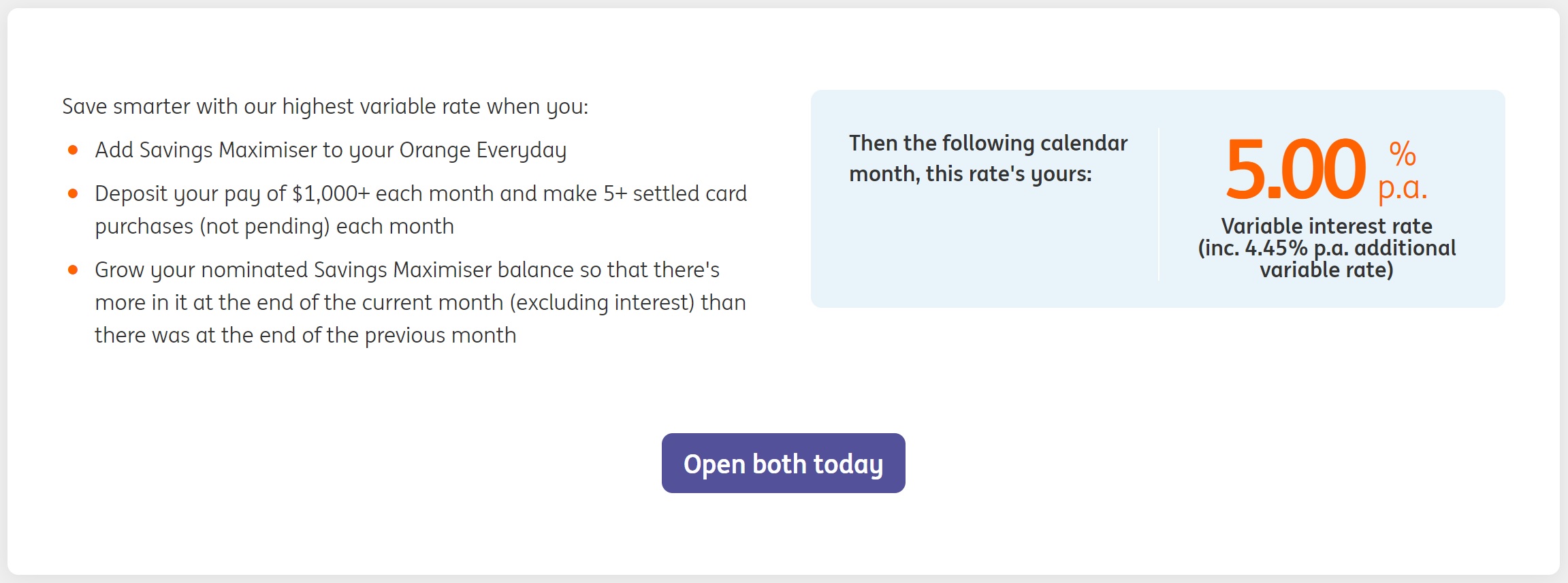

Boost your interest with a Savings Maximiser account. At the time of writing, account holders can earn up to 4.05% p.a. variable interest on an account balance up to $100,000. To access this rate, you will need to deposit at least $1,000 into your Orange Everyday account, every month, and use your card to make five purchases, and grow your Savings Maximiser balance.

The ING Everyday ‘Round Up’ feature offers a handy way to grow a savings balance by automatically rounding up card purchases, and keeping the rounded amount for a nominated Savings Maximiser account.

Bank your way with the flexibility to undertake online banking, on your mobile app, iPad, over the phone or at Australia Post outlets.

Joint bank account capability positions the Orange Everyday account with the ability to be set up as a combined household bills account, or to operate as a joint account.

Free replacement Visa card in Australia or overseas takes some of the stress out of the unfortunate event when your card is lost or stolen.

Stay Secure (Visa secure) allows ING Everyday account holders to benefit from Visa’s security features, meaning that you will have peace of mind knowing that you will not be held liable for any fraudulent transactions made using your card.

International transaction fee rebate enables account holders to bank overseas without fees. Whether travelling abroad, or shopping online with international retailers, you won’t incur ING international transaction fees on your transactions as long as you deposit $1,000 into your account each month, and make at least five purchases using your card during the same period.

International ATM withdrawal rebate: Full fee rebate on the first five eligible fee incurring ATM withdrawal transactions of the month as long as you deposit at least $1,000 into your account each month, and make five purchases using your card within the month.

Pros

- Utility bill cashback

- $0 ATM withdrawl fees on ING ATM network

- 5 rebated overseas ATM withdrawl per month

- No international transaction fees

Cons

- $1,000 monthly deposit requirement

- Cap on ATM withdrawl rebates

- 5 card purchases required per month

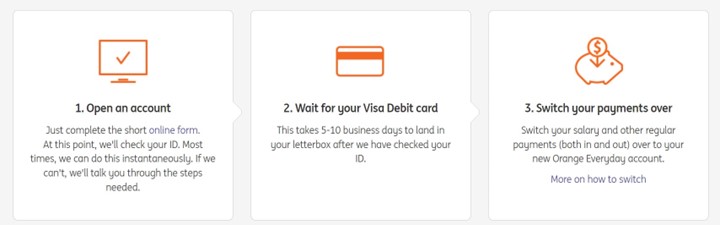

How to apply for the ING Everyday account

Signing up for a new ING Everyday account is free and the process can be completed within a few minutes.

First, you’ll need to complete a short mobile-friendly online form on the ING website.

Here, you will be required to provide the identification listed further below. Usually, ING will verify your identity straight away, however, if they are unable to do this, you’ll have to head to an Australia Post outlet.

Once your application has been accepted, your new ING Orange Everyday Visa debit card should arrive in the mail to your residential address within five to ten business days.

Eligibility

Signing up for an ING Orange account is fairly straightforward, but there are some eligibility requirements to be aware of before you apply.

| Minimum age to apply | 18 years |

| Residency requirement | Australian citizen or permanent resident with a valid Australian address |

| ID requirements | Two forms of ID (driver’s licence, passport, birth certificate or Medicare card) |

| Personal information | ING requests a mobile phone number and email address |

Fees and charges

When it comes to foreign ATM and transaction fees, the ING Orange Everyday account is somewhat complex to unpack.

Failing to meet the $1,000 monthly deposit and card purchases requirement per month will result in ING customers being charged 3% on each overseas transaction (including online purchases from overseas retailers).

While the ING Orange Everyday account used to offer unlimited free ATM transactions, it is now capped at the first five of each month, meaning account holders may need to be strategic when using ATMs in Australia and overseas.

The table below provides an overview of the fees and charges that ING Orange Everyday account holders can expect to incur when using their debit card.

| Account keeping fee | $0 |

| ATM withdrawal fee (own network) | $0 (however, external ATM operators may charge a fee) |

| ATM withdrawal fee (overseas) | $5 (first five withdrawal fees rebated if you meet the monthly requirement) |

| Foreign transaction fee | 3% (full rebate if you meet the monthly deposit and purchase requirements) |

It is important to note that while account holders won’t incur a fee at most major bank-owned ATMs in Australia and overseas, some external ATM operators may charge their own fees.

The ATM operator must, however, notify you of any fees. Pay attention to any fee messages on the ATM when withdrawing cash, particularly when you are travelling overseas.

Providing the monthly minimum purchase and deposit requirements are met, ING will rebate the ATM withdrawal fee and the ATM operator fee. However, standard ATM fees will apply after the first 5 ATM charges are rebated to you.

Could an ING Orange Everyday account be right for you?

An ING Orange Everyday account may offer value, particularly for Australians who want to benefit from cashback in their pocket after paying bills. In saying that, the maximum amount of $100 cash back per financial year may not be enough to appeal to all potential account holders.

Fulfilling a monthly $1,000 deposit and making five card purchases each month could position the ING Orange Everyday account as an appealing option for frequent overseas travellers and online shoppers. However, less frequent spenders may incur foreign transaction and ATM fees that could make this account a less ideal option to use for travel.

Travel aside, used alongside an accompanying ING Savings Maximiser account, cardholders can benefit from competitive interest rates, withdrawing as many times as they like without losing bonus interest. Bonus interest and a ‘Round Up’ feature could also make the ING Orange account a good fit for the more savings-minded.

FAQ: ING Orange Everyday account

Does ING charge international fees?

ING offers $0 ING international transaction fees on online and overseas purchases. Terms and Conditions apply.

Will I pay for overseas ATM withdrawl fees?

You’ll save on fees with up to 5 rebated ATM withdrawal fees a month, provided you meet eligibility criteria.

Can I get cashback with an ING Orange Everyday account?

Yes, $100 Utility bill payment cashback is available per year, subject to meeting eligibility criteria.

While you’re here: Subscribe to our newsletter for the latest tips, deals and news. It only takes a few seconds and we respect your privacy:

Can we open a joint orange everyday account as aged pensioners depositing our fortnightly pension payment of $1980 and be above the 5 transactions per month

Hi, you will need to meet the eligibility terms, including the minimum transaction requirements each month. If you’re unsure, I’d suggest giving ING a call to check.