If you’re in the market for a low fee, travel-friendly transaction account that also pays interest, then the Macquarie Transaction Account could be the answer. Many transaction accounts don’t offer any interest, so this benefit could help you reach your money goals sooner.

What is the Macquarie Transaction Account?

The Macquarie Transaction Account is a bank account that offers easy access to your money, while paying interest and paying less fees.

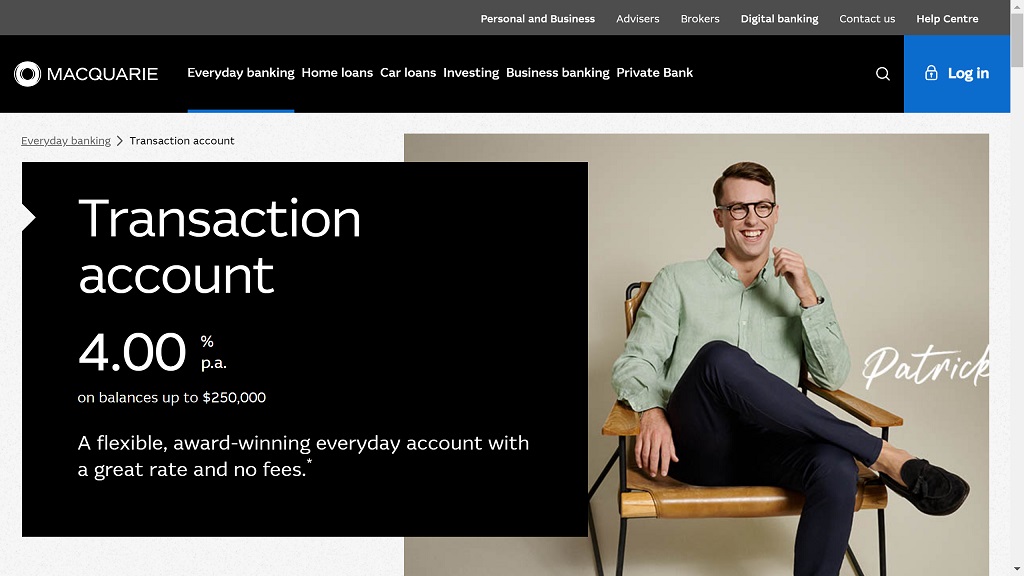

An earn rate of up to 4.00% interest, no account fees, no international fees and refunds on all Australian ATM fees are some of the features that set the Macquarie Transaction Account apart from the pack.

The table below highlights some of the Macquarie Transaction Account features at a glance:

| Product name | Macquarie Transaction Account |

| Issued by | Macquarie Bank |

| Card network: | Mastercard |

| Free transactions per month | Unlimited |

| Daily payment limit | $5,000 across all eligible accounts linked to your Macquarie ID (without Macquarie Authenticator, or $100,000 with Macquarie Authenticator. |

| Savings interest rate | 4.00% p.a. on account balances up to $250,000 3.45% p.a. on balances between $250,000.01 – $1,000,000 2.60% p.a. on balances $1,000,000.01 and above. |

| Mobile wallets | Apple Pay, Google Pay |

| Account funding options | BPAY |

Macquarie Transaction Account features

The Macquarie Transaction Account has some key features that may position it above other options. From earning interest to saving on account fees, this account could benefit prospective cardholders in more ways than one.

Saving sorted: Get the best of both worlds with access to your money whenever you want it, all while earning interest. You’ll earn up to 4.00% interest on your balance, with no requirements to maintain a minimum balance.

No account-keeping fees: You won’t be charged any monthly account-keeping fees with the Macquarie Transaction Account, regardless of your account activity.

ATM freedom: If you’re charged an ATM fee at any ATM in Australia, Macquarie will refund the total fee back into your account. Gone are the days of searching far and wide for the right ATM.

Travel overseas with ease: No international purchase fees mean you can use your Macquarie debit Mastercard online or overseas without worrying about foreign transaction fees.

Overseas ATMs made easy: Macquarie won’t charge an ATM fee for overseas withdrawals, but be aware that the ATM operator may still charge a fee (which Macquarie does not refund).

Pay on the go: You can use your debit card to make easy Tap & Go payments, as well as link your card to Apply Pay or Google Pay to make contactless payments with your device – No more worrying about leaving your wallet at home.

Easy account management: Digital access makes it easy to manage your money from wherever you are. You can access your money via internet banking or from your pocket via the Macquarie Mobile Banking app.

Shop almost anywhere: Enjoy easy shopping at home and in person with retailers with a widely accepted debit Mastercard.

How to apply for Macquarie Transaction Account

Opening a single or joint Macquarie Transaction Account is fairly straightforward and can be done online in just a few minutes.

You can apply for this account by visiting Macquarie Bank’s website and filling out a mobile-friendly online application form with the required details and documentation.

Then, once your details have been confirmed, Macquarie Bank Limited will open your account and mail a linked debit Mastercard to your address.

The processing timeframe depends on how quickly Macquarie can verify your identity and assess your application, but the Transaction Account can generally be approved within minutes.

There are no physical branches for applications, so you’ll need to be comfortable submitting the online form. Alternatively, you may be able to call Macquarie Bank to open a Transaction Account by phoning 1800 442 370.

Pros

- Interest on balance, with no minimum required

- $0 ATM withdrawal fees domestic and international

- No account-keeping fees

- No foreign transaction fees

Cons

- Mastercard, not Visa

- No physical branches to apply at

Eligibility

Unlike many other transaction accounts, children over the age of 12 can open a Macquarie Transaction account.

You’ll need to provide an email address and go through a quick ID verification process when applying.

The table below outlines the Macquarie Transaction Account’s eligibility requirements:

| Minimum age to apply | 12 years |

| Residency requirement | You must reside in Australia |

| ID requirements | A valid Australian driver’s license or passport |

It’s worth noting the Macquarie Transaction Account is for individuals (single or joint applications) and is not available to businesses.

Fees and charges

One of the perks is that there are no account-keeping fees on the Macquarie Transaction Account. You also won’t need to pay fees on online banking payments or dishonour fees.

Locally, you can use your Macquarie debit Mastercard at any ATM without worrying about fees. In fact, Macquarie.com will refund you for any ATM fees in Australia.

It is, however, worth noting that although Macquarie doesn’t charge overseas ATM fees, some operators may charge their own fee. Keep an eye out, as you will be notified of any fees at the time of withdrawal.

The table below shows what fees you can expect with the Macquarie Transaction Account:

| Account keeping fee | $0 |

| ATM withdrawal fee (own network) | $0 |

| ATM withdrawal fee (overseas) | $0 |

| Foreign transaction fee | 0% |

Overseas transactions with the Macquarie Transaction account are processed using the Mastercard foreign exchange rate.

Could The Macquarie Transaction Account be right for you?

Whether you’re jetting off or staying closer to home, the Macquarie Transaction Account could be worth considering.

The ability to access your money on demand and earn interest on your balance is a unique feature of this account, setting it apart from other transaction accounts.

Plus, you should be able to avoid international transaction fees when shopping online and overseas, which could make this card a good travel companion.

It is important to note that while account holders won’t incur a fee at most major bank-owned ATMs in Australia and overseas, some external ATM operators may charge their own fees.

Macquarie will refund any ATM fees incurred in Australia; however, this means cardholders can only avoid fees altogether in Australia. With that in mind, be sure to pay attention to any fee messages on the ATM when withdrawing cash, particularly when you are travelling overseas.

The online application process and digital account management may not suit some prospective cardholders, howe the Macquarie Transaction Account is generally suited for younger cardholders.

If you like to shop, travel and have savings goals, then the Macquarie Transaction Account could be for you.

FAQ: Macquarie Transaction Account

How do I open a Macquarie transaction account?

You can apply for this account by visiting Macquarie Bank’s website and filling out a mobile-friendly online application form with the required details and documentation.

Are there account-keeping fees on the Macquarie Transaction Account?

One of the perks is that there are no account-keeping fees on the Macquarie Transaction Account.

Do I earn interest on my money in a Macquarie Transaction Account?

No, a Macquarie Transaction Account does not pay interest on the money held in the account.

How much do you charge to withdraw cash from an ATM in the UK please??

Thank you

Hi Allan, this post is simply a review of the Macquarie Transaction accoint, we do not issue the product and don’t have oversight of fees charged on UK ATMs. ATM fees are generally set by the provider, and these can vary. Generally, you should be notified of the applicable fee at the point of withdrawing money.